Key Takeaways

- Medicare Advantage plans offer a bundled alternative to Original Medicare, which is gaining significant attention due to its comprehensive nature.

- Understanding the benefits and limitations of Medicare Advantage plans is crucial for anyone considering their healthcare coverage options this year.

Why Everyone’s Talking About Medicare Advantage Plans This Year and What You Need to Know

Medicare Advantage plans have become a hot topic in healthcare discussions this year, and it’s no surprise why. These plans, which provide an alternative to Original Medicare, have seen a rise in popularity due to their potential for offering more comprehensive coverage. However, with the increased attention also comes a need for clarity. As more people look into these plans, understanding the nuances of Medicare Advantage is essential. This article delves into why these plans are under the spotlight and what you need to know before considering them as part of your healthcare coverage.

The Rising Popularity of Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, have seen a significant increase in enrollment over the past few years. As of 2023, more than 50% of Medicare beneficiaries are enrolled in Medicare Advantage plans, a notable jump from previous years. This trend suggests a growing preference for the all-in-one nature of these plans, which often include additional benefits beyond what Original Medicare offers, such as dental, vision, and prescription drug coverage.

Several factors contribute to this surge in popularity. First, the expansion of plan offerings and the increased availability of these plans in various regions make them accessible to a broader population. Additionally, the marketing efforts surrounding Medicare Advantage have heightened awareness, leading more individuals to explore their options.

What Are Medicare Advantage Plans?

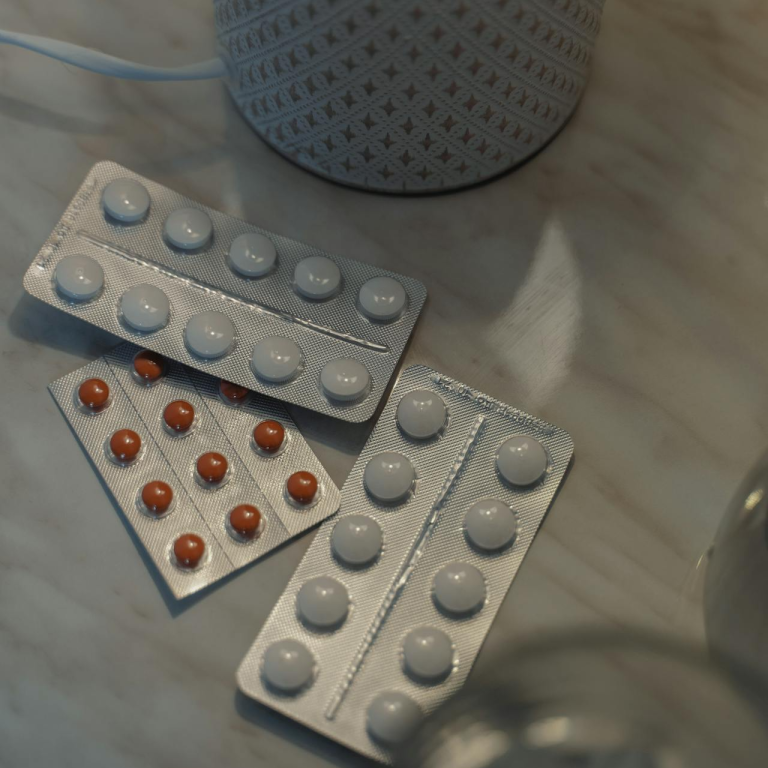

Medicare Advantage plans are an alternative to Original Medicare, offered by private insurance companies approved by Medicare. These plans must provide at least the same level of coverage as Original Medicare (Part A and Part B), but they often include additional benefits. Depending on the plan, these additional benefits can range from routine dental care to wellness programs and prescription drug coverage.

Unlike Original Medicare, where beneficiaries typically have separate plans for prescription drugs (Part D) and may need supplemental coverage (Medigap), Medicare Advantage plans often bundle these services into one plan. This bundling can make managing healthcare needs more straightforward and, in some cases, more cost-effective for the beneficiary.

Why Are People Considering Medicare Advantage Plans This Year?

The increasing attention on Medicare Advantage plans this year can be attributed to several factors. First, the COVID-19 pandemic has led many to reevaluate their healthcare needs. The comprehensive nature of Medicare Advantage plans, with their additional benefits and out-of-pocket cost limits, appeals to those seeking more predictable healthcare expenses.

Moreover, legislative changes and updates to Medicare have made these plans more attractive. For instance, there has been a push to enhance the quality of care provided under Medicare Advantage plans, with additional funding directed toward plans that achieve high performance ratings. This push for quality has resulted in better plan options for beneficiaries, making Medicare Advantage plans more appealing.

What Are the Benefits of Medicare Advantage Plans?

Medicare Advantage plans offer several benefits that can make them an attractive option for beneficiaries. Here are some key advantages:

1. Comprehensive Coverage

Medicare Advantage plans provide a one-stop-shop for healthcare needs, often including services like dental, vision, and hearing care, which are not covered by Original Medicare. This all-in-one approach simplifies the management of healthcare services and can reduce the need for multiple insurance plans.

2. Out-of-Pocket Maximum

One significant benefit of Medicare Advantage plans is the out-of-pocket maximum, which limits how much a beneficiary will spend on covered services in a year. Original Medicare does not have such a cap, which can lead to higher out-of-pocket costs in the event of significant medical needs.

3. Wellness Programs

Many Medicare Advantage plans offer wellness programs designed to promote healthier lifestyles. These may include gym memberships, nutrition counseling, and other health-focused benefits that are not available through Original Medicare.

4. Coordinated Care

Medicare Advantage plans often emphasize coordinated care, where your healthcare providers work together to provide more streamlined care. This can be especially beneficial for those with chronic conditions, as it helps ensure that all aspects of your care are managed effectively.

5. Prescription Drug Coverage

Many Medicare Advantage plans include prescription drug coverage, eliminating the need for a separate Part D plan. This integration can simplify the management of medications and potentially reduce costs.

What Are the Potential Drawbacks of Medicare Advantage Plans?

While Medicare Advantage plans offer several benefits, they are not without potential drawbacks. It’s essential to consider these factors when evaluating whether a Medicare Advantage plan is right for you:

1. Network Restrictions

Medicare Advantage plans typically operate within specific networks of doctors and hospitals. This means that if you seek care outside of the network, your costs could be significantly higher, or the care may not be covered at all. This can be a drawback for those who value flexibility in choosing their healthcare providers.

2. Plan Complexity

Medicare Advantage plans can be complex, with varying benefits, coverage options, and costs. Navigating these options requires careful consideration and comparison to ensure that you select a plan that meets your specific healthcare needs.

3. Prior Authorization Requirements

Some Medicare Advantage plans require prior authorization for certain services, which means that you’ll need to get approval from your plan before receiving care. This can lead to delays in treatment and added administrative tasks.

4. Potential for Higher Out-of-Pocket Costs

While Medicare Advantage plans have an out-of-pocket maximum, some plans may have higher cost-sharing requirements for certain services compared to Original Medicare. It’s important to review the plan details to understand potential costs fully.

How to Decide if Medicare Advantage is Right for You?

Choosing between Original Medicare and Medicare Advantage is a personal decision that depends on your healthcare needs, financial situation, and preferences. Here are some tips to help you decide:

1. Evaluate Your Healthcare Needs

Consider your current health status and any ongoing medical needs. If you require frequent doctor visits, prescription medications, or specialized care, a Medicare Advantage plan’s bundled services might offer more convenience and potentially lower costs.

2. Consider Your Budget

Review the potential out-of-pocket costs for each option. While Medicare Advantage plans have an out-of-pocket maximum, you’ll need to consider other costs like premiums, copayments, and coinsurance. Compare these with the costs you’d incur under Original Medicare plus a Medigap policy.

3. Check the Provider Network

If you have preferred doctors or healthcare facilities, make sure they are in the network of the Medicare Advantage plans you are considering. This will help avoid unexpected costs and ensure continuity of care.

4. Research Plan Options

Take the time to compare different Medicare Advantage plans in your area. Look at the benefits, costs, and provider networks to find a plan that aligns with your needs. It’s also helpful to read reviews and ratings from current enrollees to gauge the quality of the plans.

Navigating the Annual Enrollment Period

The Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year, is the time when Medicare beneficiaries can make changes to their coverage. Whether you’re switching from Original Medicare to a Medicare Advantage plan, or changing from one Medicare Advantage plan to another, the AEP is your opportunity to review your options and make an informed decision.

During this period, it’s crucial to review any changes to your current plan’s costs, coverage, and provider network. Insurance companies often adjust their plan offerings annually, so even if you’re satisfied with your current plan, it’s worth checking to see if another option might better meet your needs.

Explore Your Medicare Options

As the popularity of Medicare Advantage plans continues to grow, it’s more important than ever to understand your options. These plans offer a range of benefits that can provide more comprehensive coverage than Original Medicare, but they also come with potential drawbacks that must be considered. By carefully evaluating your healthcare needs, budget, and preferences, you can make an informed decision about whether a Medicare Advantage plan is right for you.

For more detailed information and to explore your options further, consider consulting with a licensed insurance agent who can provide personalized guidance based on your unique situation.

Stay Informed About Your Healthcare Choices

Understanding the intricacies of Medicare Advantage plans is crucial for making the right healthcare decisions. With more people turning to these plans for their comprehensive coverage and additional benefits, staying informed will help you navigate the complexities of Medicare. Remember, the best plan for you is the one that meets your specific needs and fits within your budget.

Contact Information:

Email: [email protected]

Phone: 3365550123