Key Takeaways:

- Recognizing common Medicare scams can help protect your financial and personal information.

- Safeguarding yourself from fraud involves understanding red flags and taking proactive measures to secure your Medicare details.

Medicare Scams Are on the Rise – Here’s How to Spot Fraud and Protect Yourself

Medicare scams are becoming increasingly sophisticated, targeting unsuspecting beneficiaries with various schemes to steal personal information or commit financial fraud. As Medicare fraud continues to rise in 2024, it’s crucial to stay informed about the latest tactics scammers use and learn how to protect yourself effectively. Understanding the red flags, maintaining vigilance, and taking proactive steps are key to preventing these fraudulent activities.

Common Types of Medicare Scams in 2024

Medicare fraud schemes have evolved with technology, and scammers are employing more convincing tactics to deceive beneficiaries. Below are some of the most prevalent scams in 2024:

1. Phishing Emails and Phone Calls

Scammers posing as Medicare representatives often contact beneficiaries through email or phone, claiming there’s an issue with their account or offering fake services. These phishing scams usually involve requests for personal information such as Medicare numbers, Social Security numbers, or bank account details.

Red Flag: Medicare will never ask for sensitive information via phone or email. If someone does, it’s a scam.

2. Fraudulent Medical Equipment Schemes

In this scam, fraudsters convince Medicare beneficiaries that they qualify for “free” medical equipment, such as back braces or wheelchairs, often stating it’s covered by their Medicare plan. Once they collect your Medicare information, they bill Medicare for expensive equipment you may not even need.

Red Flag: Be suspicious of unsolicited calls or ads offering medical equipment for “free.”

3. Fake COVID-19 Tests and Treatments

As the pandemic continues to influence healthcare systems, scammers are using COVID-19 as a front for Medicare fraud. They may offer fake COVID-19 tests, vaccines, or treatments, asking for Medicare details to cover the “cost.”

Red Flag: COVID-19-related services should come from trusted medical professionals. Be cautious of anyone requesting Medicare information for unsolicited health services.

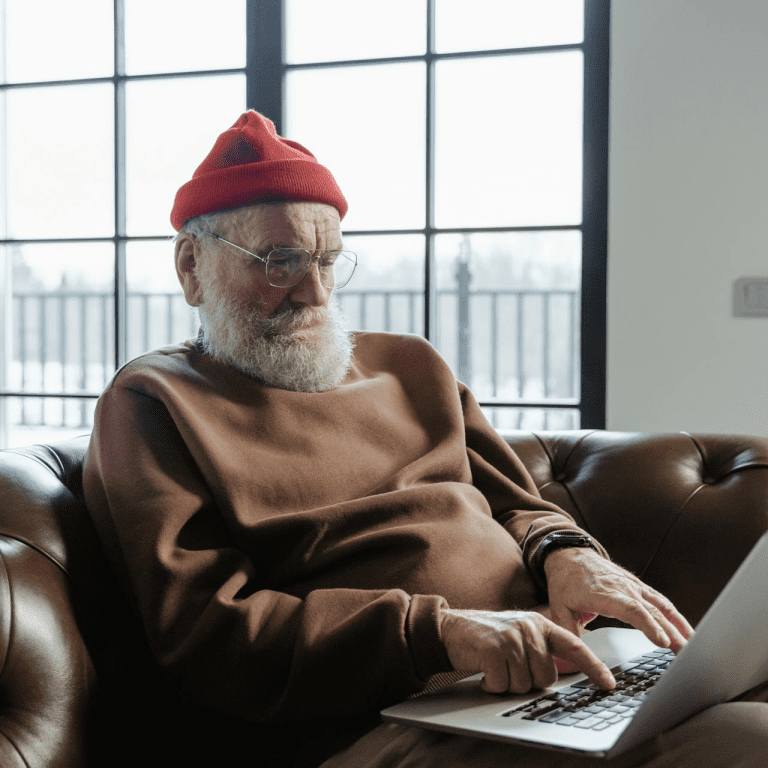

4. Telemedicine Scams

Telemedicine has become a widely accepted healthcare service, but scammers have taken advantage of its rise by offering fake telehealth appointments. These fraudsters may pretend to schedule medical visits or offer consultations only to gather personal information for fraudulent purposes.

Red Flag: Always verify the legitimacy of the telemedicine provider before giving out any Medicare information.

5. Fake Medicare Advantage or Drug Plan Enrollment

During Medicare enrollment periods, scammers often pose as licensed insurance agents, convincing beneficiaries to switch plans under false pretenses. They may promise non-existent benefits or ask for payment for services that are usually free of charge, all while collecting your Medicare or banking details.

Red Flag: Licensed insurance agents will not ask for payments for enrollment services. Be wary of anyone rushing you to make decisions.

How to Spot Medicare Fraud

Being aware of common tactics is essential, but knowing how to spot Medicare fraud in your day-to-day interactions is equally important. Here are some ways to recognize fraudulent activity:

1. Unsolicited Contact

If you receive an unexpected phone call, email, or visit from someone claiming to be a Medicare representative, it’s most likely a scam. Medicare does not contact beneficiaries unless they request assistance first.

2. Pressure to Act Quickly

Scammers often create a false sense of urgency, pressuring you to act immediately or lose out on services. Legitimate Medicare representatives give you time to review options and never force you to make decisions on the spot.

3. Requests for Sensitive Information

Any request for your Medicare number, Social Security number, or bank account details from an unsolicited source should raise immediate suspicion. Medicare already has your details and will not ask for them unless you initiate contact.

4. Offers That Sound Too Good to Be True

Scammers often entice their victims with promises of free services, extra benefits, or better plans. Always be cautious of offers that seem too good to be true, especially during enrollment periods.

Protecting Yourself Against Medicare Scams

While it can be daunting to think about the potential for fraud, there are several steps you can take to protect yourself and your Medicare information.

1. Guard Your Medicare Number

Your Medicare number is as valuable as your Social Security number. Never give it out unless you’re absolutely sure you’re dealing with a legitimate source. Keep your Medicare card in a safe place and avoid carrying it with you unless necessary.

2. Review Your Medicare Summary Notices (MSNs) and Explanations of Benefits (EOBs)

Regularly check your MSNs and EOBs for any suspicious charges or services you did not receive. Fraudulent activity often shows up in these documents before other signs appear. If you notice any discrepancies, report them immediately to Medicare.

3. Use Trusted Sources for Medicare Information

Whenever you’re looking for Medicare information or services, always go directly to official sources like Medicare.gov or contact licensed insurance agents. Avoid using third-party websites or responding to unsolicited offers over the phone or email.

4. Hang Up on Suspicious Calls

If you receive a call that feels suspicious or makes you uncomfortable, hang up immediately. Do not engage with the caller, and never give out personal or Medicare information over the phone unless you initiated the call.

5. Monitor Your Financial Accounts

Keep a close eye on your bank accounts and credit reports to catch any unauthorized transactions. Scammers often use stolen information to access your accounts, so it’s important to act quickly if you detect any unusual activity.

6. Report Medicare Fraud

If you suspect Medicare fraud, report it immediately to the proper authorities. You can contact Medicare directly or use the Medicare Fraud Hotline at 1-800-MEDICARE (1-800-633-4227). Reporting fraud helps protect not only yourself but also other beneficiaries from falling victim to scams.

Stay Vigilant During Medicare Enrollment Periods

Medicare enrollment periods, such as the Annual Election Period (AEP), are a prime time for scammers to strike. During these periods, you’re likely to receive numerous communications about plan options, making it difficult to differentiate between legitimate offers and scams. Stay vigilant by:

- Verifying the source: Only respond to communications from trusted sources.

- Avoiding high-pressure sales tactics: Scammers often push you to make quick decisions. Always take the time to review your options carefully.

- Checking your enrollment status: If you’re unsure about your enrollment or the legitimacy of an offer, contact Medicare directly to confirm.

What to Do If You Suspect Medicare Fraud

If you believe you’ve been targeted by a Medicare scam, taking immediate action can help limit the damage. Here’s what you should do:

-

Contact Medicare: Report the suspected fraud by calling Medicare at 1-800-MEDICARE. Be prepared to provide details about the incident.

-

File a Complaint: If you believe a licensed insurance agent has acted unethically, you can file a complaint with your state’s insurance department.

-

Alert Financial Institutions: If you’ve shared any financial information with a scammer, notify your bank or credit card company to prevent unauthorized transactions.

-

Consider a Credit Freeze: If your Medicare or Social Security number was stolen, placing a credit freeze can prevent identity thieves from opening accounts in your name.

Stay Informed to Safeguard Your Medicare Benefits

As scams become more sophisticated, staying informed and vigilant is your best defense against Medicare fraud. By recognizing the warning signs, protecting your personal information, and reporting suspicious activity, you can safeguard your Medicare benefits and prevent financial losses. Remember, if something doesn’t feel right, it’s always best to err on the side of caution and verify before acting.

Contact Information:

Email: okieshoe6668@att.net

Phone: 4053148776

Bio:

My name is David Cranford. I have been married 57 years. I have three children, five grandchildren, and five great-grandchildren. I have had my insurance license since 1980. I am fully licensed in life insurance, annuities, Medicare, group health and individual health, and property and casualty insurance. I graduated from Midwest City High School in 1965, married my High School sweetheart, and earned my bachelor’s degree in 2008. I approach business from the customer’s viewpoint. I work to educate and explain the options and choices available and work to make sure the

product fits the needs and wants of the client. I work one morning a week at the local Senior Center, answering

questions for the members and the public. I am working to bring my son into the business with me to provide the

service and support all clients deserve in the years ahead.