Key Takeaways:

- Medicare coverage is divided into distinct parts, each serving different healthcare needs, making it easier to understand how to access services.

- Knowing the difference between Medicare Parts A, B, C, and D can help you manage healthcare expenses more effectively.

Breaking Down Medicare Coverage in Simple Terms So You Can Finally Understand Your Benefits

Medicare can feel confusing with all its parts, rules, and coverage options. Many people wonder exactly what it covers, and how it impacts their healthcare needs. Understanding Medicare doesn’t have to be difficult, though. In this article, we’ll break down each component of Medicare in easy-to-understand terms. By the end, you’ll have a clearer picture of how Medicare works and what your benefits truly are.

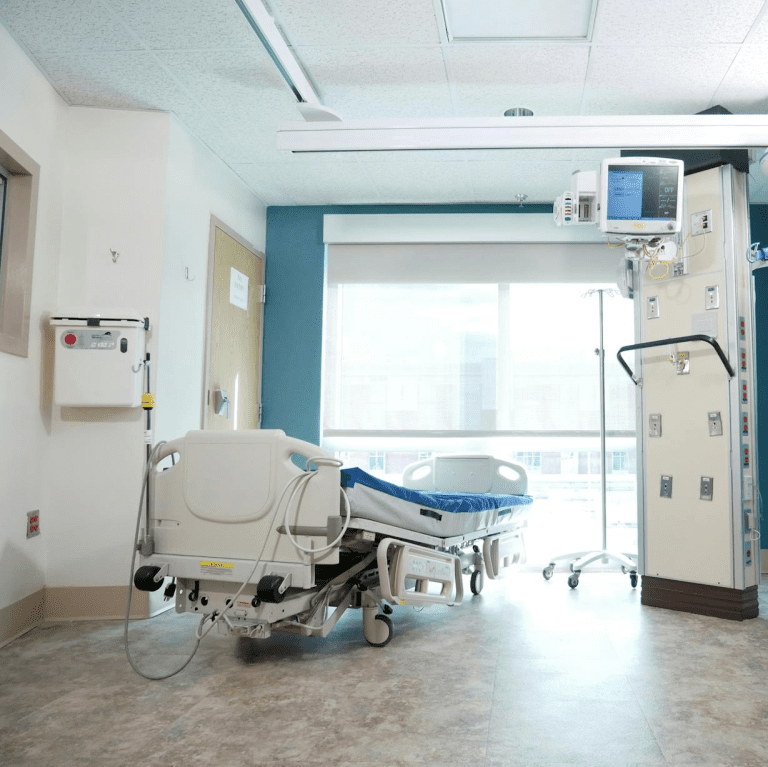

Medicare Part A: Hospital Insurance Explained

Medicare Part A, often referred to as hospital insurance, is the part of Medicare that covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care services. For most people, Part A is available without a monthly premium if they or their spouse paid Medicare taxes while working.

It’s important to note that while Part A covers many critical services, it doesn’t cover everything. For instance, long-term care in a nursing home isn’t included. If you’re admitted to the hospital, Part A will help cover the costs of your stay, including services like meals, medications, and general nursing care. However, there are deductibles and coinsurance costs that may apply, so understanding what out-of-pocket costs you might face is important.

Medicare Part B: Medical Insurance for Outpatient Services

Medicare Part B covers outpatient care, preventive services, doctor visits, lab tests, and medical equipment. Think of Part B as the part that helps you manage regular doctor visits, screenings, and non-hospital medical care. Unlike Part A, most people do have to pay a monthly premium for Part B, although the amount can vary based on income.

Part B also includes preventive care, like flu shots and cancer screenings, aimed at catching potential health issues early. Coverage under Part B helps manage everyday health expenses, making it essential for those who need ongoing care but aren’t hospitalized.

There are annual deductibles for Part B, as well as coinsurance costs that typically cover about 80% of approved healthcare expenses, leaving you responsible for the remaining 20%. Understanding these financial responsibilities is key to planning your medical expenses.

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, is an alternative way to receive Medicare benefits. Offered by private insurance companies approved by Medicare, Part C plans combine Part A and Part B coverage into one plan. Many Medicare Advantage plans also include prescription drug coverage, vision, dental, and hearing services.

Choosing a Medicare Advantage plan means you still have Medicare, but you’re getting coverage through a private insurance company instead of the traditional Medicare program. These plans may offer additional benefits beyond Original Medicare, but it’s essential to understand the network of doctors and hospitals available under the plan.

Each Medicare Advantage plan is different, so it’s important to compare what each offers, including premiums, out-of-pocket costs, and additional benefits. Keep in mind that enrolling in a Medicare Advantage plan might affect your access to certain healthcare providers, so research your options carefully.

Medicare Part D: Prescription Drug Coverage Simplified

Prescription drug coverage is provided through Medicare Part D. This part of Medicare helps cover the cost of prescription medications and is offered through private insurance companies. If you have Original Medicare, you’ll need to enroll in a standalone Part D plan to get this coverage.

Part D plans vary in cost and the specific drugs they cover, which makes it crucial to choose a plan that covers your current medications. Each Part D plan has a formulary, or a list of covered drugs, and costs can vary depending on whether your prescription is considered a generic, brand-name, or specialty drug.

One key thing to remember about Part D is the “donut hole” or coverage gap, where you might pay more out-of-pocket for your prescriptions after you’ve reached a certain spending threshold. However, the donut hole has been shrinking over the years, making prescription drug costs more manageable for many people.

Medigap: Filling in the Gaps of Medicare

Medigap, also known as Medicare Supplement Insurance, is designed to help pay for the out-of-pocket costs not covered by Original Medicare, such as deductibles, coinsurance, and copayments. Medigap policies are sold by private companies and work alongside Medicare Part A and Part B.

There are different Medigap plans to choose from, each offering a slightly different set of benefits. While these policies can help reduce your healthcare costs, they do require a monthly premium in addition to your Part B premium.

It’s also important to know that Medigap plans don’t work with Medicare Advantage. If you opt for a Medicare Advantage plan, you won’t be able to purchase Medigap coverage, so understanding how these two options differ is crucial when deciding on your coverage.

How to Choose the Right Medicare Coverage

Choosing the right Medicare coverage depends on your individual healthcare needs. The first step is understanding the different parts of Medicare and what they cover. Here are some factors to consider when deciding between Original Medicare (Part A and B), a Medicare Advantage plan (Part C), and whether to add a Part D prescription plan or Medigap coverage:

-

Healthcare Needs: Think about the types of care you need. If you require frequent doctor visits or take multiple prescription medications, you may benefit from adding a Part D plan or opting for a Medicare Advantage plan that includes drug coverage.

-

Provider Access: Original Medicare allows you to see any doctor that accepts Medicare, while Medicare Advantage plans typically require you to use a network of providers. If it’s important to you to have a wide range of doctors to choose from, Original Medicare might be a better fit.

-

Costs: Consider the premiums, deductibles, and out-of-pocket costs associated with each type of Medicare coverage. Medigap policies can help reduce your out-of-pocket expenses if you choose Original Medicare, while Medicare Advantage plans may offer lower premiums but with restricted access to healthcare providers.

-

Additional Benefits: Some Medicare Advantage plans offer extra benefits, such as dental, vision, or hearing coverage. While these can be appealing, be sure to weigh the value of these benefits against potential limitations in the network or increased out-of-pocket costs for other services.

Important Deadlines to Keep in Mind

Enrollment periods for Medicare are strict, and missing them can result in penalties or delayed coverage. Here’s a quick breakdown of key Medicare enrollment periods:

-

Initial Enrollment Period: This is a seven-month window that begins three months before you turn 65, includes your birthday month, and lasts three months afterward.

-

General Enrollment Period: If you miss your initial enrollment period, you can sign up for Medicare between January 1 and March 31 each year, but coverage won’t begin until July 1. Late penalties may apply.

-

Special Enrollment Period: If you’re still working past age 65 and have employer-sponsored health insurance, you may qualify for a special enrollment period after your employment ends. This allows you to enroll in Medicare without facing late enrollment penalties.

Understanding Medicare’s Role in Your Healthcare

Medicare plays a critical role in providing healthcare coverage as you age. By familiarizing yourself with the different parts of Medicare, you’ll be better equipped to make informed decisions about your healthcare coverage. Remember, it’s essential to review your Medicare options annually, as plans and coverage details can change from year to year.

Planning Your Medicare Decisions for the Future

As healthcare needs change, so might your Medicare coverage. Make sure to periodically review your Medicare choices, especially during the Annual Election Period. Staying informed and proactive ensures that you continue to have the coverage that best meets your needs, whether it’s adjusting prescription drug plans or switching from Original Medicare to a Medicare Advantage plan.