Key Takeaways:

- Understanding Medicare basics can simplify your transition, making it easier to choose the coverage that meets your needs.

- Medicare is divided into different parts, each designed to cover specific healthcare services, so knowing the differences is essential.

Getting Ready for Medicare: What to Expect

When you’re about to start Medicare, it’s natural to feel a mix of excitement and uncertainty. With so many parts and options, it can seem overwhelming. But don’t worry—I’m here to help you understand the basics so you can make informed decisions as you begin this new chapter. Whether you’re enrolling for the first time or transitioning from another health insurance plan, understanding the fundamentals of Medicare can set you up for success.

What Is Medicare and Who Is It For?

Medicare is a federal health insurance program primarily for people aged 65 and older, although certain younger individuals with disabilities or specific medical conditions may also qualify. It’s designed to help cover various medical expenses, from hospital visits to preventive services, but it’s important to note that Medicare doesn’t cover everything. You might need additional insurance for comprehensive coverage, which can include prescription drugs or supplemental plans.

Breaking Down the Different Parts of Medicare

Medicare is divided into four main parts, each offering different types of coverage. It’s crucial to understand what each part covers so you can decide what’s right for you.

Part A: Hospital Insurance

Medicare Part A helps cover inpatient hospital stays, skilled nursing facilities, hospice care, and some home health services. Most people don’t pay a premium for Part A if they or their spouse have paid Medicare taxes for a sufficient period. While it covers essential services, it’s not exhaustive, and costs like deductibles or coinsurance might apply.

Part B: Medical Insurance

Medicare Part B covers outpatient care such as doctor visits, medical supplies, preventive services, and some forms of therapy. Unlike Part A, Part B requires a monthly premium, which is determined based on your income. Understanding your Part B costs is essential because they can add up, and this part also involves an annual deductible.

Part C: Medicare Advantage Plans

Part C, or Medicare Advantage, is offered through private companies approved by Medicare. These plans combine the coverage of Part A and Part B, and often include prescription drug coverage and additional benefits like vision, dental, or hearing services. However, these plans might come with network restrictions, meaning you’ll need to use specific doctors and facilities.

Part D: Prescription Drug Coverage

Medicare Part D is designed to cover prescription medications. It’s available through private insurance companies and works as an add-on to Original Medicare (Parts A and B). Each plan has its own formulary, which is a list of covered drugs, so reviewing this list is crucial to ensure the medications you need are included.

When Should You Enroll in Medicare?

Enrolling in Medicare isn’t automatic for everyone, so understanding when to sign up is key. Most people enroll when they turn 65 during their Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after. If you miss this window, you may face late enrollment penalties or gaps in your coverage, making it essential to mark your calendar.

If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Parts A and B when you turn 65. However, if you’re still working and have employer coverage, you might choose to delay Part B enrollment without penalty. Always check with your benefits administrator to determine what’s best for your situation.

What Costs Should You Expect?

Medicare isn’t free. Although Part A typically comes without a premium, there are other costs to consider. Part B requires a monthly premium, and if you opt for Medicare Advantage (Part C) or a Part D plan, those may also have their own premiums, deductibles, and copayments. Understanding these costs ahead of time will help you budget and plan for your healthcare expenses.

Keep in mind that the out-of-pocket expenses for Medicare Advantage and Part D plans can vary significantly depending on the coverage and company you choose. Consider what kind of care you anticipate needing to select a plan that aligns with your health needs and financial situation.

How Do Medicare and Medicaid Differ?

It’s easy to confuse Medicare and Medicaid, but they are different programs. Medicare is a federal program focused on those over 65 or with certain disabilities, regardless of income. Medicaid, on the other hand, is a state and federal program providing healthcare for individuals with low income. Some people qualify for both Medicare and Medicaid, called “dual-eligible” individuals, allowing them to access more comprehensive benefits and minimize out-of-pocket costs.

What Is Medigap, and Do You Need It?

Medicare doesn’t cover everything, which is where Medigap (Medicare Supplement Insurance) comes into play. Medigap policies are sold by private companies to help pay for costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. It’s important to note that Medigap is different from Medicare Advantage; Medigap supplements your Original Medicare coverage, while Medicare Advantage replaces it.

If you decide that Original Medicare is the right choice for you, exploring Medigap options might help minimize unexpected expenses. However, you can’t have both a Medigap policy and a Medicare Advantage plan simultaneously, so it’s crucial to understand your healthcare priorities before deciding.

Tips for Choosing the Right Medicare Plan

Choosing the right Medicare plan is a personal decision, but there are a few steps that can help you make an informed choice:

-

Assess Your Healthcare Needs: Consider your current health status and any regular medical treatments or medications you need. This will help you decide whether a plan with broader coverage, like Medicare Advantage, might suit you better than Original Medicare alone.

-

Compare Costs: Review the premiums, deductibles, and other out-of-pocket expenses associated with each part of Medicare. This will give you a clear picture of your total healthcare costs and help you select a plan that fits your budget.

-

Check Provider Networks: If you’re leaning toward Medicare Advantage, make sure your preferred doctors and hospitals are in-network. This can significantly affect your out-of-pocket expenses if you need to seek care outside the network.

-

Review Prescription Drug Coverage: If you take specific medications, check the Part D plans available in your area to ensure your prescriptions are covered. Formularies can vary widely, so it’s important to choose a plan that minimizes your medication costs.

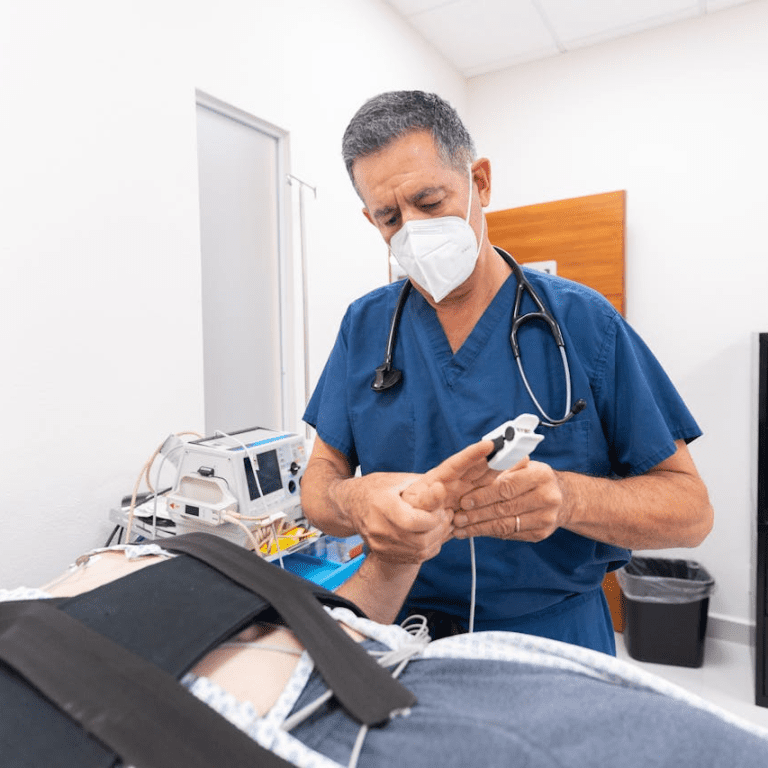

How Can You Make the Most of Preventive Services?

One of Medicare’s key benefits is its coverage for many preventive services, such as annual wellness visits, screenings for various conditions, and vaccinations. Taking advantage of these services can help you stay ahead of potential health issues and maintain a higher quality of life as you age. Since preventive services are generally covered at no additional cost under Part B, scheduling them regularly is a smart way to maximize your benefits.

Where Can You Get Help?

Navigating Medicare can be challenging, and there’s no need to go through it alone. Licensed insurance agents are available to assist you with questions about enrollment, coverage options, and plan comparisons. Additionally, you can visit Medicare.gov for up-to-date information or to use the plan finder tool. This tool is particularly useful for comparing costs, coverage, and provider networks among available plans in your area.

What Should You Know About Changing Medicare Plans?

Life circumstances change, and so might your healthcare needs. If you want to change your Medicare plan, the Annual Enrollment Period (AEP) runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to Medicare Advantage (or vice versa), change Medicare Advantage plans, or join, switch, or drop a Part D plan. It’s a great opportunity to reassess your coverage and make adjustments based on your evolving needs.

However, if you qualify for a Special Enrollment Period (SEP) due to certain life events, such as moving or losing other health coverage, you might be able to make changes outside the AEP. It’s important to stay informed about these opportunities to ensure you always have the right coverage.

Preparing for Your Medicare Journey

Starting Medicare is a significant step, and having the right information at your fingertips can make all the difference. By understanding the basics, reviewing your options, and seeking guidance when needed, you’ll be well-equipped to make the best choices for your healthcare needs.