Key Takeaways

-

Medicare remains one of the most confusing systems to understand on your own, especially with new 2025 updates like the Part D out-of-pocket cap and shifting Advantage plan benefits.

-

You can access clear, personalized guidance through trusted national resources, state-run programs, and licensed agents who know the system inside and out.

Why Medicare Still Feels Overwhelming in 2025

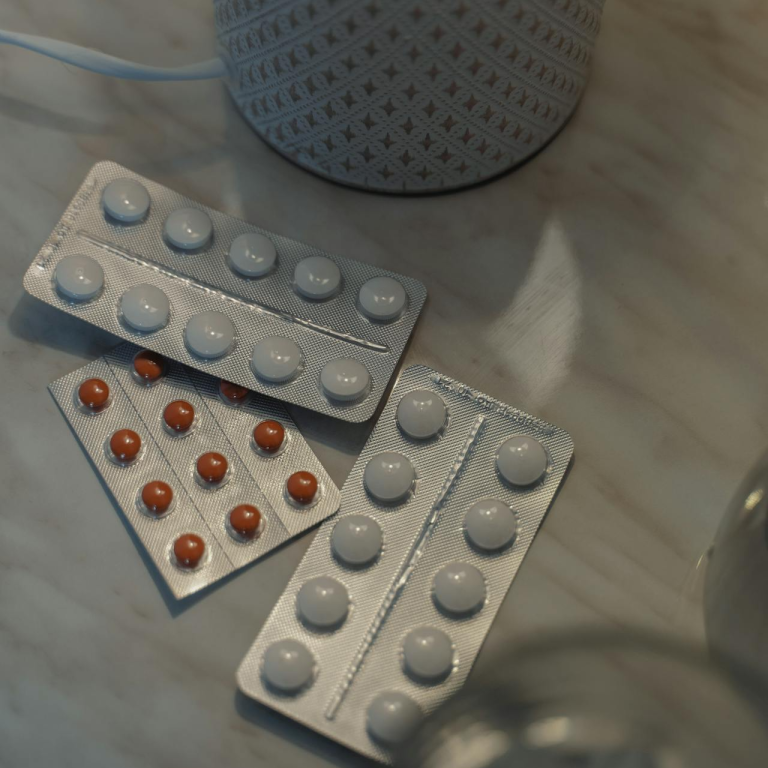

Medicare has been around for decades, but even in 2025, trying to understand it without help can feel like decoding a foreign language. Each year brings new rules, costs, and terms. This year, for example, the introduction of a $2,000 out-of-pocket cap on prescription drugs sounds simple—but when paired with drug tiers, prior authorizations, and payment timelines, it becomes anything but.

On top of that, Medicare Advantage plans have adjusted some of their supplemental benefits in 2025. Fewer plans offer transportation or over-the-counter benefits, and many have modified their out-of-pocket maximums. The changes aren’t always obvious in a plan brochure. You often need a second set of eyes to understand the details that could cost or save you thousands.

Who Actually Helps You—and Who Just Confuses You More

If you’ve ever searched online for Medicare help, you’ve probably run into a wall of conflicting information. Some sources may push a specific product. Others speak in generalities without ever answering your real question.

Fortunately, not all sources are created equal. In 2025, there are clear, trusted options where you can get answers that are:

-

Unbiased and based on federal rules

-

Tailored to your personal coverage situation

-

Consistent with 2025 changes and enrollment deadlines

Let’s walk through where you can turn when the Medicare maze gets too complicated to manage alone.

1. Start with Medicare.gov—But Know Its Limits

Medicare.gov is the official source for information about coverage, enrollment, and plan comparisons. You can:

-

Create a secure Medicare account

-

Compare Original Medicare and Advantage plans

-

Review drug plan options

-

Look up preventive services

In 2025, Medicare.gov reflects updates like the out-of-pocket drug cap and current deductibles ($257 for Part B, $1,676 for Part A inpatient hospital stays). But while it’s a great starting point, it doesn’t provide personalized guidance. It won’t explain why your copay suddenly increased or whether switching plans makes sense based on your health needs.

2. SHIP Counselors: Free Local Help That’s Actually Personal

Every state offers a State Health Insurance Assistance Program (SHIP), funded by the federal government. These programs are staffed by trained counselors who:

-

Offer one-on-one help

-

Understand state-specific plan options and Medicaid eligibility

-

Can review your drug list with you

-

Are not affiliated with any insurance company

SHIPs are especially valuable during Medicare’s Annual Enrollment Period (October 15 through December 7), but they’re available year-round. In 2025, more SHIP offices are expanding to include virtual appointments, which means even rural or homebound individuals can access this support.

3. Licensed Agents: Private but Regulated—and Held Accountable

Licensed insurance agents who specialize in Medicare can be a reliable option—if you work with one who is properly certified and up to date on current rules.

A licensed agent can:

-

Compare multiple plan options side by side

-

Explain the pros and cons of Original Medicare vs. Medicare Advantage

-

Walk you through how drug tiers affect your Part D costs

-

Help with Special Enrollment Periods if you retire or move mid-year

In 2025, Medicare regulations require licensed agents to follow strict disclosure rules. They must clarify what plans they represent and cannot mislead you about coverage or benefits. If they violate these rules, they can lose their license.

You can speak with a licensed agent listed on this website if you need that level of tailored, up-to-date help.

4. Social Security: Essential for Enrollment, Limited for Advice

While Medicare is run by the Centers for Medicare & Medicaid Services (CMS), you enroll through the Social Security Administration (SSA).

Social Security can help you:

-

Enroll in Part A and B at age 65 (or earlier if you’re eligible by disability)

-

Apply for Extra Help with drug costs

-

Update your income records if you think you’re being charged the wrong IRMAA (income-related monthly adjustment)

But they won’t help you choose a Medicare Advantage or Part D plan. Their role is administrative—not advisory. In 2025, you can do most of this online or by scheduling an appointment at your local SSA office.

5. Your State’s Medicaid Office If You Have a Limited Income

If your income is below a certain threshold, your state Medicaid program can offer valuable support. You may qualify for:

-

A Medicare Savings Program to help pay Part B premiums

-

Full Medicaid benefits alongside Medicare

-

Dual-eligible Special Needs Plans (D-SNPs)

These programs are more important than ever in 2025, especially given rising healthcare costs and cost-sharing obligations. Your local Medicaid office—or a SHIP counselor—can walk you through eligibility and application.

6. 1-800-MEDICARE: When You Need Fast Answers

This federal helpline is open 24 hours a day, 7 days a week. Representatives can:

-

Help you understand what your Medicare card means

-

Review your current plan enrollment

-

Confirm if a service is covered

-

Connect you with local resources like SHIP

While it’s not a substitute for long-term planning, 1-800-MEDICARE is one of the few resources that’s both fast and official. In 2025, the helpline reflects all current policy changes, including drug cost caps and updated Advantage plan limits.

What to Avoid When Looking for Help

With the amount of information online, it’s just as important to know what not to trust. Be cautious of:

-

Websites that promise one perfect plan for everyone: No plan is ideal for everyone—coverage is personal.

-

Cold calls or aggressive sales tactics: In 2025, cold calling for Medicare sales is strictly regulated. Anyone contacting you without permission is likely in violation.

-

Outdated brochures or 2024 plan documents: Always check that you’re looking at 2025 materials. Even small differences can be costly.

-

Random forums or social media advice: While well-intentioned, what worked for someone else might be wrong for you.

When Should You Ask for Help?

It’s not just during Open Enrollment that you might need Medicare advice. You may want help in any of the following situations:

-

You’re turning 65 and aren’t sure what you need to sign up for

-

You’re still working and wonder whether you can delay Part B

-

You’ve noticed your drug costs increasing unexpectedly

-

You’re moving to a new state or ZIP code

-

You’ve been diagnosed with a new health condition and need different coverage

-

You received a letter about IRMAA or a plan change you don’t understand

In 2025, with new rules, higher premiums, and changing benefits, it’s smarter than ever to get help before making any coverage changes.

A Recap of the Support Systems You Can Trust

Let’s quickly summarize the most trustworthy sources for Medicare help this year:

-

Medicare.gov – Reliable and comprehensive, but not personalized

-

SHIP – Free, state-run, and customized to your situation

-

Licensed agents – Private but helpful when working with someone reputable

-

Social Security – Necessary for enrollment and income-based adjustments

-

Medicaid offices – Great for low-income individuals needing full or partial support

-

1-800-MEDICARE – Immediate help with general or urgent questions

Each of these options plays a different role. Used together, they provide a safety net so that you never have to feel like you’re figuring Medicare out by yourself.

Finding Clarity in a Complex System

You don’t have to face Medicare decisions alone. In 2025, the rules are more intricate, the stakes are higher, and the costs can add up quickly if you miss something. But help is readily available—if you know where to look.

Reach out today to speak with a licensed agent listed on this website. They can walk you through your current plan, help you understand new cost changes, and make sure you’re fully covered for the year ahead.