Key Takeaways

- Medicare Advantage plans can provide all-in-one coverage with additional benefits, but they may limit your provider choices and include out-of-pocket costs.

- Understanding your personal healthcare needs and preferences is essential before deciding if Medicare Advantage is right for you.

Medicare Advantage Plans: The Basics

Medicare Advantage plans, also known as Part C, are offered by private insurers approved by Medicare. They combine coverage for hospital stays (Part A), medical services (Part B), and often include prescription drug coverage (Part D). These plans may also offer extras like dental, vision, and hearing services, which aren’t covered under Original Medicare.

But here’s the catch: these plans aren’t one-size-fits-all. They come with benefits and limitations that could either work perfectly for you or leave you feeling boxed in. Let’s dig deeper into what makes Medicare Advantage shine for some and fail for others.

Why Some People Love Medicare Advantage Plans

All-in-One Coverage

One of the most appealing features of Medicare Advantage is its simplicity. You get hospital, medical, and often prescription drug coverage all bundled into one plan. No more juggling between multiple policies and worrying about how they interact.

Extra Perks

Medicare Advantage plans often include benefits that Original Medicare doesn’t. Think gym memberships, routine vision exams, and even transportation for medical appointments. These perks can make a real difference if you rely on such services.

Predictable Costs

While Original Medicare leaves you paying 20% of most services with no cap on out-of-pocket costs, Medicare Advantage plans often include annual out-of-pocket maximums. Once you hit that limit, the plan covers 100% of your in-network expenses for the rest of the year.

Coordinated Care

Many Medicare Advantage plans operate within Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs). This often means your healthcare providers communicate with each other to manage your care efficiently. It’s a feature especially valuable if you have chronic conditions requiring frequent check-ups and treatments.

The Downside of Medicare Advantage Plans

Limited Provider Networks

One major downside? You might not be able to see your preferred doctor or specialist. Many plans restrict you to their network of providers. If you venture outside this network, you could face higher costs or lose coverage altogether.

Prior Authorizations

Want to see a specialist or get a specific procedure done? You may need prior authorization from your plan. This step can delay your care, and in some cases, lead to denials for treatments your doctor recommends.

Out-of-Pocket Costs

While the annual out-of-pocket maximum is helpful, you’ll still encounter copayments, coinsurance, and deductibles. These costs can add up, especially if you need frequent medical care or expensive treatments.

Geographic Restrictions

If you’re a snowbird or someone who travels often, a Medicare Advantage plan might not meet your needs. Coverage is typically tied to your plan’s service area, meaning you could be out of luck if you require care outside that zone.

When Medicare Advantage Might Be Right for You

You’re Healthy and Budget-Conscious

If you don’t have significant healthcare needs and want predictable monthly expenses, Medicare Advantage could work well. The additional benefits like dental and vision might add value, especially if you’d otherwise pay out-of-pocket for these services.

You Prefer Coordinated Care

For those who appreciate a more streamlined healthcare experience, especially if managing multiple conditions, Medicare Advantage plans often shine in this area. Your care team will typically work together to provide comprehensive treatment.

You Live in an Urban Area

Medicare Advantage plans tend to have larger provider networks in metropolitan areas. If you live in a city, chances are you’ll find plenty of in-network options close to home.

When Medicare Advantage Might Be Totally Wrong for You

You Want Maximum Freedom to Choose Providers

If you value the ability to see any doctor or specialist who accepts Medicare, Original Medicare may better suit your needs. Medicare Advantage plans often limit you to their network, which can be restrictive.

You Have Frequent Medical Needs

Frequent visits to specialists or out-of-network providers can quickly escalate your out-of-pocket costs. In these cases, the uncapped 20% coinsurance under Original Medicare (with a Medigap plan to fill the gaps) may be more predictable.

You Split Your Time Between Two Locations

Travelers or snowbirds should consider that many Medicare Advantage plans have strict service area rules. If you need regular care in multiple locations, sticking with Original Medicare is likely a better fit.

Making the Right Choice: What to Consider

Assess Your Health Needs

Think about your current medical conditions, how often you see doctors, and whether you anticipate major medical expenses. This will help you estimate your potential costs under both Medicare Advantage and Original Medicare.

Factor in Your Preferred Doctors

Check whether your favorite providers are in-network for the Medicare Advantage plans you’re considering. If they aren’t, you’ll need to weigh the trade-off between staying with them and saving money.

Think About Your Lifestyle

Are you a frequent traveler or a seasonal resident in another state? Original Medicare offers nationwide coverage, whereas Medicare Advantage plans can be geographically restrictive.

Look at Prescription Drug Needs

If you take multiple medications, compare how those prescriptions are covered under Medicare Advantage versus a standalone Part D plan with Original Medicare.

Balancing the Costs

Monthly Premiums vs. Out-of-Pocket Costs

While Original Medicare has separate premiums for Parts B and D, Medicare Advantage typically bundles everything into one. However, you’ll still face copayments or coinsurance for many services under Medicare Advantage, so you’ll need to calculate your total costs carefully.

Annual Out-of-Pocket Maximums

This feature of Medicare Advantage plans caps your financial exposure for the year. In contrast, Original Medicare has no out-of-pocket maximum, though you can purchase a Medigap policy to fill in the gaps.

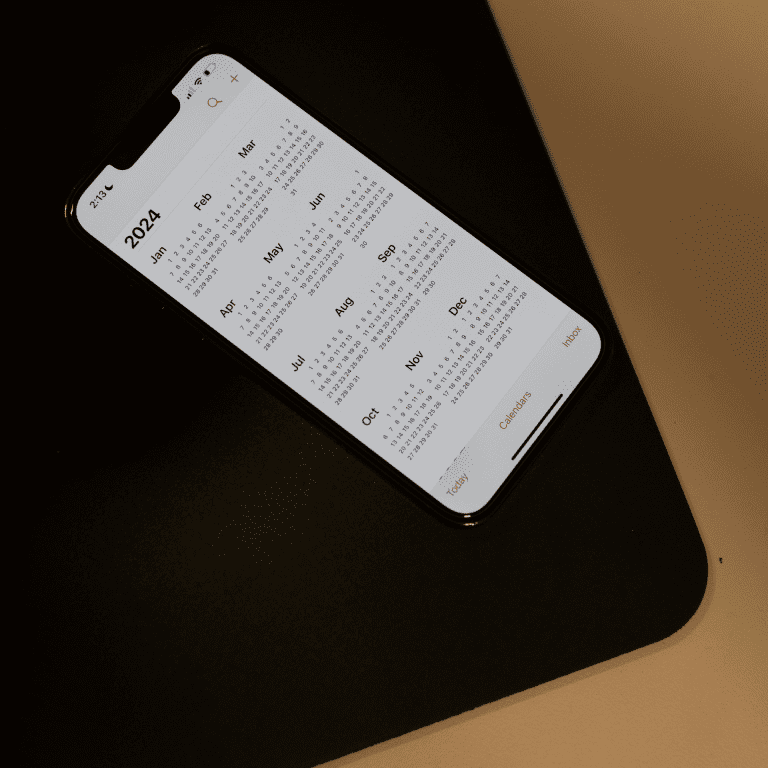

Understanding the Enrollment Periods

The timing of your decision is critical. Here’s a breakdown of when you can join or switch plans:

- Initial Enrollment Period (IEP): This 7-month window starts 3 months before the month you turn 65 and ends 3 months after.

- Annual Enrollment Period (AEP): From October 15 to December 7, you can switch between Medicare Advantage and Original Medicare or change Advantage plans.

- Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31, current Medicare Advantage enrollees can switch plans or go back to Original Medicare.

- Special Enrollment Periods (SEP): Triggered by specific life events like moving or losing employer coverage, these allow changes outside the regular enrollment periods.

What’s Your Medicare Strategy?

Choosing between Medicare Advantage and Original Medicare is personal and depends on your health needs, budget, and lifestyle. Take the time to explore your options, compare plans, and think about how each aligns with your long-term goals.

Remember, you can reevaluate your choice during enrollment periods if your needs change. Healthcare is dynamic, and your Medicare plan should adapt to serve you best.