Key Takeaways

-

Recent Medicare regulation changes in 2025 impact premiums, deductibles, and cost-sharing structures, requiring you to review your plan carefully.

-

Staying informed about these updates can help you optimize benefits, avoid unexpected expenses, and make educated decisions during open enrollment.

Understanding the 2025 Medicare Changes and How They Affect You

Medicare undergoes updates every year, and 2025 is no exception. If you rely on Medicare for your healthcare needs, staying informed about these changes can help you maximize your coverage and avoid unexpected costs. Whether it’s shifts in premiums, modifications to out-of-pocket expenses, or adjustments to eligibility rules, knowing what’s new ensures you’re not caught off guard.

What’s Changing in Medicare This Year?

The changes in 2025 touch multiple aspects of Medicare, from premiums to prescription drug costs. Here’s a breakdown of the key updates:

Premium and Deductible Adjustments

Medicare costs shift annually, and this year, you may notice changes in your monthly premiums and deductibles. Some areas that have been adjusted include:

-

Medicare Part A: The hospital deductible has increased, along with cost-sharing amounts for extended hospital stays and skilled nursing facilities.

-

Medicare Part B: The standard monthly premium has risen, as has the annual deductible, which means you’ll need to budget for higher out-of-pocket costs before coverage kicks in.

-

Medicare Part D: Prescription drug plans now include an annual out-of-pocket cap, reducing financial burdens for high-cost medications.

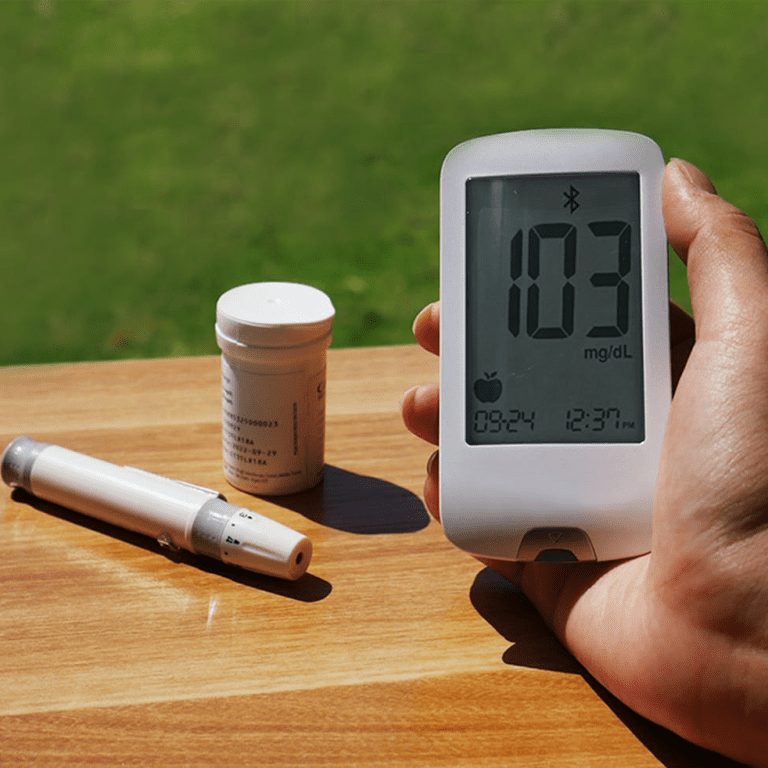

Prescription Drug Cost Reforms

This year marks a significant shift in how Medicare handles prescription drug expenses:

-

The infamous donut hole is officially eliminated, meaning once you reach the out-of-pocket spending threshold, your plan covers 100% of covered drug costs.

-

A new $2,000 out-of-pocket cap has been introduced, protecting you from excessive medication expenses.

-

The Medicare Prescription Payment Plan allows you to spread out drug costs over monthly payments rather than paying large sums at once.

Medicare Advantage Plan Adjustments

While Medicare Advantage (Part C) plans vary by region and provider, general trends indicate:

-

Some supplemental benefits have changed, with fewer plans offering over-the-counter allowances and transportation services.

-

A mid-year notification now informs enrollees of unused benefits to encourage plan utilization.

-

Cost-sharing structures, such as co-pays and out-of-pocket maximums, may have shifted, so it’s important to review your plan’s details.

How Seniors Are Adapting to These Changes

Understanding the modifications in Medicare is just one part of the equation. Adapting to them is just as critical. Here’s how many Medicare beneficiaries are responding to the 2025 updates.

Reevaluating Coverage During Open Enrollment

The Medicare Open Enrollment Period, which runs from October 15 to December 7, is the best opportunity to reassess your plan. Many seniors are using this period to:

-

Compare current plan costs against new options.

-

Switch between Original Medicare and Medicare Advantage based on benefits and affordability.

-

Adjust Part D prescription drug plans to take advantage of the new out-of-pocket cap.

Exploring Medicare Supplement (Medigap) Options

With changes in cost-sharing, some beneficiaries are looking into Medicare Supplement Insurance (Medigap) plans to help cover out-of-pocket expenses. If you’re concerned about higher deductibles or co-pays, this could be a viable option.

Budgeting for Higher Costs

Higher premiums and deductibles mean more out-of-pocket spending. Many seniors are adjusting their budgets accordingly by:

-

Setting aside savings for increased Medicare Part B costs.

-

Factoring in prescription drug expenses and exploring lower-cost generic alternatives.

-

Utilizing preventive care services covered by Medicare to reduce long-term healthcare expenses.

Taking Advantage of Preventive Services

Medicare covers a range of preventive care services at no additional cost. With cost increases in other areas, many beneficiaries are focusing on:

-

Annual wellness visits to catch health issues early.

-

Vaccinations such as flu, pneumonia, and shingles shots.

-

Screenings for conditions like diabetes, heart disease, and certain cancers.

Key Considerations for Your Medicare Strategy in 2025

To make the most of your coverage this year, keep these strategies in mind:

Stay Informed About Plan Changes

Your Annual Notice of Change (ANOC) letter, sent every September, outlines all modifications to your current Medicare plan. Read this carefully to see if your premiums, deductibles, or benefits have changed.

Review Your Prescription Drug Plan

With the new $2,000 out-of-pocket cap, some plans may offer better savings than others. Compare different Part D plans to ensure you’re getting the best deal on your medications.

Consider Medicare Advantage vs. Original Medicare

If your Medicare Advantage plan has reduced benefits or increased cost-sharing, switching back to Original Medicare with a Medigap plan might be a more cost-effective option.

Use Available Resources

Many organizations offer assistance in navigating Medicare, including:

-

State Health Insurance Assistance Programs (SHIPs) for free counseling.

-

Medicare.gov for plan comparison tools and official updates.

-

Local senior centers that provide Medicare workshops and educational sessions.

What to Expect in the Future

The changes in 2025 are just the beginning. Looking ahead, here’s what might be on the horizon:

-

Further prescription drug pricing reforms aimed at reducing costs for seniors.

-

Increased telehealth access as Medicare continues to expand coverage for virtual care services.

-

Additional cost adjustments to premiums and deductibles, which are likely to occur annually.

Staying proactive about Medicare changes can help you maintain the best possible coverage while keeping costs manageable.

Staying Ahead of Medicare Changes This Year

Medicare’s evolving landscape means that each year brings new costs, benefits, and regulations. By staying informed and reassessing your coverage during open enrollment, you can make the best choices for your healthcare needs. Whether it’s switching plans, taking advantage of preventive care, or budgeting for higher expenses, being proactive ensures that you get the most out of your Medicare benefits in 2025.