Key Takeaways:

- The Annual Enrollment Period (AEP) allows Medicare beneficiaries to switch to Original Medicare without penalties.

- AEP is the only period when changes are penalty-free, ensuring coverage updates take effect on January 1, 2025.

Switching Back to Original Medicare? Why AEP Is the Only Time to Do It Without Penalties

The Medicare Annual Enrollment Period (AEP) for 2024 runs from October 15 to December 7. This period is critical for anyone considering switching back to Original Medicare without facing penalties. Any changes made during AEP will take effect starting January 1, 2025, providing an important opportunity to review and adjust your coverage to meet your healthcare needs for the upcoming year. Understanding the details of AEP ensures beneficiaries make informed decisions without incurring additional costs or penalties.

What Is the Annual Enrollment Period (AEP)?

The Annual Enrollment Period, or AEP, is a designated timeframe each year when Medicare beneficiaries can make changes to their Medicare coverage. It’s the only period when beneficiaries can:

- Switch from a Medicare Advantage plan back to Original Medicare (Part A and Part B).

- Change from one Medicare Advantage plan to another.

- Enroll, drop, or switch Part D prescription drug plans.

The changes you make during AEP will take effect on January 1 of the following year. It’s crucial to make any adjustments during this window, as it’s the only time when changes can be made penalty-free, especially if you’re switching back to Original Medicare.

Why AEP Matters for Those Returning to Original Medicare

For many beneficiaries, switching back to Original Medicare is a strategic decision based on evolving healthcare needs or preferences for broader provider access. AEP is vital for these changes because:

-

Penalty Avoidance: Outside of AEP, switching plans can result in penalties or delayed coverage changes. AEP offers a penalty-free opportunity to transition back to Original Medicare seamlessly.

-

Ensuring Coverage Continuity: By making the switch during AEP, you guarantee that the new coverage takes effect on January 1, ensuring no gaps in your healthcare coverage for the upcoming year.

How Does AEP Work for Switching Back to Original Medicare?

Switching back to Original Medicare is straightforward during AEP, but it requires understanding the process and planning accordingly.

-

Determine Eligibility: Ensure you are eligible for Original Medicare (Parts A and B). Most individuals aged 65 or older qualify, as well as some younger individuals with disabilities.

-

Review Current Coverage: Analyze your current Medicare Advantage plan or other Medicare plans to determine whether staying or switching is more beneficial. Consider aspects such as network restrictions, costs, and coverage options.

-

Consider Additional Coverage: When switching back to Original Medicare, you may also want to consider enrolling in a standalone Medicare Part D plan for prescription drug coverage or a Medigap (Medicare Supplement) policy to cover gaps like deductibles and copayments.

-

Enroll During AEP: Use the AEP window (October 15 – December 7) to make the switch. Contact Medicare or a licensed insurance agent for guidance, ensuring your changes are correctly processed.

Comparing Medicare Advantage vs. Original Medicare: Pros and Cons

| Aspect | Original Medicare (Part A & B) | Medicare Advantage |

|---|---|---|

| Network Flexibility | Access to any doctor or hospital that accepts Medicare | Limited to in-network providers depending on the plan |

| Prescription Coverage | Requires separate Part D plan | Often includes prescription coverage |

| Out-of-Pocket Costs | No out-of-pocket max; requires supplemental coverage (Medigap) | Typically has out-of-pocket max, but limited network |

| Additional Benefits | Doesn’t cover dental, vision, or hearing | Often includes extra benefits like dental, vision, and fitness |

Switching back to Original Medicare gives you more provider flexibility but requires supplemental plans for comprehensive coverage.

When Can You Make the Switch Without Penalties?

Medicare beneficiaries are allowed to switch from Medicare Advantage back to Original Medicare during the AEP without facing any penalties. Outside of AEP, making such changes can lead to:

- Late Enrollment Penalties: If you decide to enroll in Part B later after initially declining it or dropping Medicare Advantage outside AEP, you could face a higher premium as a penalty for late enrollment.

- Coverage Delays: Changes made outside of AEP may not take effect immediately, leading to potential gaps in healthcare coverage.

To avoid these issues, it’s crucial to make changes within the AEP timeframe.

What If You Miss the AEP Window?

If you miss the AEP window, you may have to wait until the next AEP (October 15 – December 7 of the following year) to switch back to Original Medicare without penalties. However, there are limited circumstances where special enrollment periods (SEPs) may apply, such as:

- Moving out of your current plan’s service area

- Losing other healthcare coverage

- Qualifying for assistance due to financial needs

These special cases allow beneficiaries to make changes outside AEP, but it’s important to consult with Medicare or a licensed insurance agent to understand eligibility.

Making the Most Out of AEP for 2024

To ensure a smooth transition during AEP 2024, it’s crucial to prepare and act promptly:

-

Evaluate Healthcare Needs: Assess your current and anticipated healthcare needs. If you have a chronic condition or frequently travel, Original Medicare’s flexibility may be advantageous.

-

Review Costs and Coverage Options: Compare the costs of maintaining your current plan versus switching back to Original Medicare, taking into account supplemental policies and Part D plans.

-

Seek Professional Guidance: Medicare can be complex, and mistakes during enrollment can lead to coverage gaps or penalties. Consulting with a licensed insurance agent ensures you’re making the most informed decision.

Advantages of Original Medicare During AEP

Switching back to Original Medicare during AEP has several benefits:

- Nationwide Coverage: Original Medicare allows beneficiaries to access any healthcare provider that accepts Medicare, giving more flexibility than some Medicare Advantage plans with restricted networks.

- Choice of Supplements: Medigap policies complement Original Medicare, offering options that can help cover costs like copayments and deductibles, ensuring comprehensive coverage.

Does Switching Affect Your Prescription Drug Coverage?

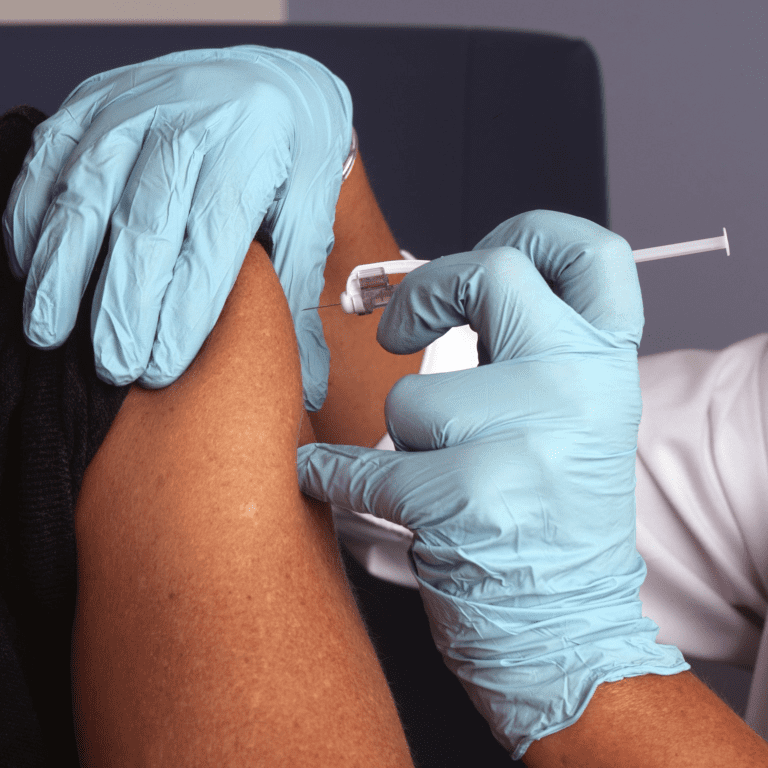

When switching back to Original Medicare during AEP, it’s important to consider how this affects your prescription drug coverage. If your Medicare Advantage plan included Part D coverage, you’ll need to enroll in a standalone Part D plan to maintain prescription drug coverage.

Here’s a simple comparison of the options:

| Option | Description | Additional Considerations |

|---|---|---|

| Medicare Advantage Plan | Often includes Part D | Integrated, but limited to network pharmacies |

| Original Medicare + Part D | Separate enrollment for Part D | Provides flexibility to choose any Part D plan |

By planning ahead, you can ensure that you continue to have coverage for necessary medications.

Avoiding Gaps in Coverage During the Switch

Ensuring a smooth transition back to Original Medicare means paying attention to enrollment timing and requirements. Here are some key tips:

- Enroll Early in AEP: Waiting until the end of the enrollment period might cause processing delays, so aim to enroll early for a seamless switch.

- Verify Supplemental Coverage: If you’re enrolling in Medigap or a Part D plan, confirm that your application aligns with your switch to Original Medicare, avoiding any potential gaps.

Preparing for Changes Effective January 1, 2025

Remember that any changes you make during AEP 2024 will take effect on January 1, 2025. It’s important to prepare for these changes ahead of time:

- Budget for Upcoming Healthcare Costs: Original Medicare and supplemental plans have different cost structures, so understanding potential out-of-pocket expenses helps you budget effectively.

- Monitor Communications from Medicare: Keep an eye out for official Medicare notices regarding your coverage, as these documents will provide important information about the changes taking effect.

Final Steps: Making Informed Choices During AEP

Switching back to Original Medicare can be an advantageous move, especially if flexibility and nationwide access to healthcare providers are priorities. However, it’s essential to make this switch during AEP to avoid penalties and coverage delays.

For any Medicare beneficiary considering this transition, thorough evaluation and preparation are key. Review all options carefully, and seek professional advice when necessary to make the most informed choice.

Ensuring a Smooth Transition

To ensure you don’t miss out on crucial changes or opportunities, always consult official Medicare resources or a licensed insurance agent during the AEP window. Their expertise helps guide you through the enrollment process, providing clarity on your choices.