Key Takeaways:

- Utilize online tools and resources to navigate Medicare options efficiently.

- Understanding enrollment periods and deadlines is crucial for timely Medicare benefits.

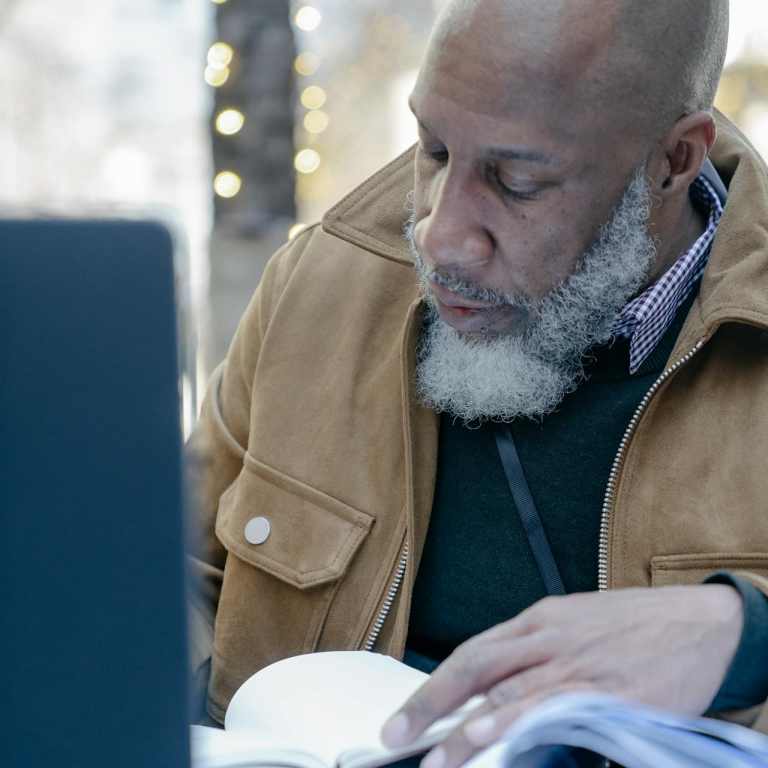

Important Medicare Resources for New Beneficiaries

Navigating Medicare can be overwhelming for new beneficiaries. With numerous plans, options, and deadlines, it’s essential to utilize reliable resources to make informed decisions. This article highlights key Medicare resources that will help new beneficiaries understand their coverage and make the most out of their benefits.

Top Online Tools for Medicare Information

The internet offers a wealth of information for Medicare beneficiaries. Several official and reputable websites provide comprehensive details about Medicare, its benefits, and how to enroll. Here are some top online tools to consider:

-

Medicare.gov: This is the official Medicare website, offering a vast array of information on all aspects of Medicare. From detailed plan comparisons to step-by-step guides on enrollment, Medicare.gov is a one-stop resource for beneficiaries.

-

MyMedicare.gov: This portal allows beneficiaries to create a personal account to manage their Medicare information. Users can view claims, track their preventive services, and find personalized information about their benefits.

-

State Health Insurance Assistance Programs (SHIPs): These programs offer free, personalized counseling and assistance to Medicare beneficiaries and their families. SHIPs can help with understanding Medicare benefits, enrollment, and rights.

-

Medicare Interactive: An online resource provided by the Medicare Rights Center, Medicare Interactive offers easy-to-understand information about Medicare benefits, rights, and options.

-

Medicare Plan Finder: A tool available on Medicare.gov, this allows beneficiaries to compare Medicare Advantage, Medicare Prescription Drug Plans, and Medigap policies based on cost, coverage, and other factors.

Key Enrollment Periods and Critical Deadlines

Understanding when to enroll in Medicare and knowing the critical deadlines can save new beneficiaries from late enrollment penalties and ensure they have continuous coverage. Here are the essential enrollment periods and deadlines:

-

Initial Enrollment Period (IEP): This seven-month period begins three months before the month you turn 65, includes your birth month, and ends three months after. It is the primary time to sign up for Medicare Parts A and B.

-

General Enrollment Period (GEP): If you miss your IEP, you can enroll in Medicare Parts A and B during the GEP, which runs from January 1 to March 31 each year. Coverage starts on July 1, but a late enrollment penalty may apply.

-

Special Enrollment Period (SEP): If you are still working and have employer health coverage at 65, you may qualify for an SEP. You can sign up for Medicare without a penalty anytime you are covered by an employer or union group health plan, and for eight months after your employment or coverage ends.

-

Annual Election Period (AEP): Also known as Open Enrollment, this period runs from October 15 to December 7 each year. During AEP, you can switch between Medicare Advantage and Original Medicare, join a Medicare Prescription Drug Plan, or change your existing plan.

-

Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31, those enrolled in a Medicare Advantage plan can switch to another Medicare Advantage plan or return to Original Medicare and join a Medicare Prescription Drug Plan.

Finding Local Help through State Health Programs

Local assistance can be invaluable for navigating Medicare’s complexities. State Health Insurance Assistance Programs (SHIPs) provide free, personalized counseling and support for Medicare beneficiaries. Here’s how SHIPs can help:

-

Personalized Counseling: SHIP counselors offer one-on-one sessions to help you understand your Medicare options and benefits. They can explain how different plans work and assist in comparing coverage options.

-

Assistance with Enrollment: SHIP counselors can guide you through the enrollment process, ensuring you meet all deadlines and understand the requirements for your chosen plan.

-

Education and Outreach: SHIPs often hold workshops and seminars to educate beneficiaries about Medicare. These events cover topics like Medicare basics, changes in Medicare, and how to avoid Medicare fraud.

-

Advocacy and Problem Resolution: If you encounter issues with your Medicare coverage, SHIP counselors can advocate on your behalf and help resolve problems with billing, claims, or coverage.

-

Resource Connections: SHIPs can connect you with other local resources, such as Social Security offices, Medicaid offices, and community health services, ensuring you have comprehensive support.

Utilizing Medicare’s Official Site and Plan Finder Tools

Medicare’s official website, Medicare.gov, and its Plan Finder tool are essential resources for new beneficiaries. Here’s how to make the most of these tools:

-

Medicare.gov:

- Detailed Plan Information: Access comprehensive details about Medicare Parts A, B, C, and D, including coverage options, costs, and enrollment processes.

- Helpful Guides: Find step-by-step guides on how to enroll in Medicare, change plans, and understand your benefits.

- FAQs and Glossaries: Use the extensive FAQ section and glossaries to clarify terms and answer common questions about Medicare.

-

Medicare Plan Finder:

- Compare Plans: Use the Plan Finder to compare Medicare Advantage plans, Prescription Drug Plans, and Medigap policies based on cost, coverage, and other factors.

- Personalized Searches: Enter your medications, preferred pharmacies, and health needs to find plans tailored to your specific situation.

- Enrollment Assistance: Once you find a plan that meets your needs, the Plan Finder provides information on how to enroll and what documents you’ll need.

Essential Resources for Medicare Enrollment

Medicare enrollment can be complex, but having the right resources can simplify the process. Here are some essential resources to consider:

-

Social Security Administration (SSA): The SSA handles Medicare enrollment for those who are not automatically enrolled. You can sign up online, by phone, or at your local SSA office.

-

Medicare & You Handbook: This annual publication from Medicare provides an overview of Medicare benefits, coverage options, and enrollment information. It’s a valuable resource for understanding your choices and staying informed about changes in Medicare.

-

State Health Insurance Assistance Programs (SHIPs): As mentioned earlier, SHIPs offer personalized counseling and assistance with enrollment, making them an essential resource for new beneficiaries.

-

Medicare Rights Center: This nonprofit organization provides information and assistance to Medicare beneficiaries, including a national helpline, educational resources, and advocacy.

-

National Council on Aging (NCOA): The NCOA offers resources and tools to help older adults navigate Medicare, including online guides and personalized assistance.

Making Informed Medicare Decisions

As a new Medicare beneficiary, it’s crucial to utilize the available resources to make informed decisions about your coverage. Whether you’re enrolling in Medicare for the first time, choosing between different plans, or seeking assistance with specific issues, these resources can help you navigate the complexities of Medicare with confidence.

By leveraging online tools, understanding critical enrollment periods, accessing local assistance programs, and utilizing official websites and plan finder tools, you can ensure you make the best decisions for your health and financial well-being.

Contact Information:

Email: [email protected]

Phone: 8305559012