Key Takeaways:

-

Each Medicare Part serves a unique purpose, helping you access healthcare and manage costs effectively.

-

Understanding the roles of Medicare Parts A, B, C, and D ensures you can make informed choices about your coverage.

Medicare Made Simple: Breaking Down the Parts

Navigating Medicare doesn’t have to feel like a maze. Each part is designed to cover specific aspects of your healthcare, giving you access to the services you need while helping to protect your finances. Let’s explore what each Medicare Part offers and how they work together to safeguard your health and wallet. To get the most out of Medicare, it’s essential to grasp the details, including how benefits interact and what costs to anticipate.

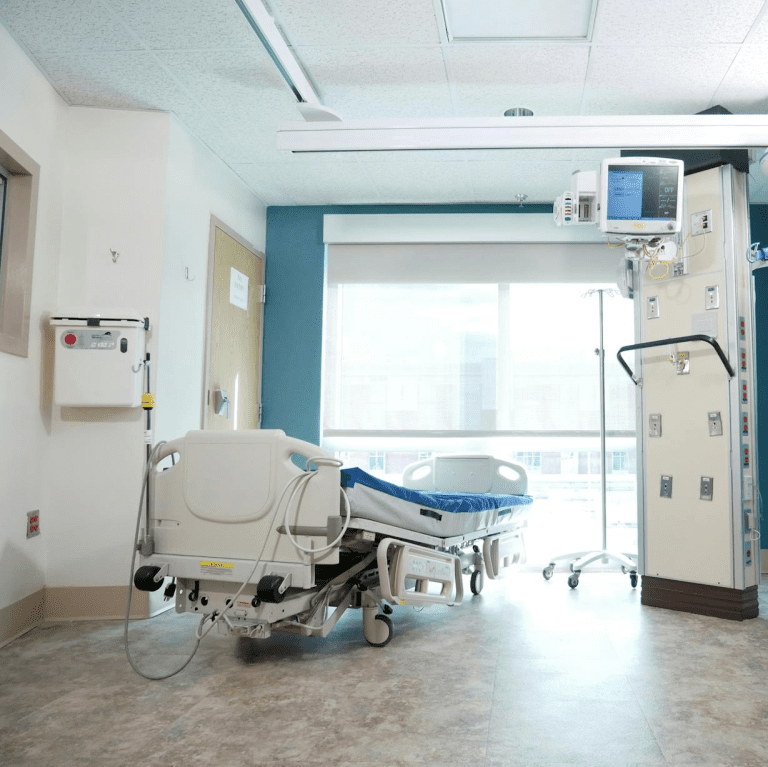

Medicare Part A: Your Hospital Coverage

Medicare Part A, also known as hospital insurance, is your safety net for inpatient care. It covers:

-

Hospital Stays: Includes a semi-private room, meals, and general nursing care.

-

Skilled Nursing Facility (SNF) Care: Covers short-term stays for rehabilitation or recovery after a hospital stay.

-

Hospice Care: Supports end-of-life services, including pain management and emotional support.

-

Home Health Care: Limited coverage for medically necessary home-based services.

Costs You Should Know

While Part A is often premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years, there are costs to keep in mind:

-

Inpatient Hospital Deductible: $1,676 per benefit period in 2025.

-

Coinsurance: After 60 days in the hospital, daily coinsurance costs start at $419.

Understanding these costs can help you avoid unexpected bills. Planning for out-of-pocket expenses ensures you have peace of mind if you need hospital care. Remember, hospital coverage often requires proper documentation and coordination with other parts of Medicare to avoid gaps in care.

Medicare Part B: Your Outpatient Ally

Medicare Part B is the go-to for outpatient medical services. It covers:

-

Doctor Visits: Includes general practitioners and specialists.

-

Preventive Services: Screenings, vaccinations, and wellness visits.

-

Outpatient Procedures: Services like surgeries and diagnostic tests.

-

Durable Medical Equipment (DME): Items like wheelchairs and oxygen tanks.

Costs at a Glance

-

Monthly Premium: $185 in 2025.

-

Annual Deductible: $257 before Medicare begins paying.

-

Coinsurance: Typically, you pay 20% of the Medicare-approved amount for services after meeting your deductible.

Part B also provides essential preventive services that can catch health issues early, often at no extra cost. Keeping up with these services not only improves health outcomes but also reduces long-term costs. With its broad scope, Part B ensures you’re covered for everything from routine visits to emergency outpatient care.

Medicare Part C: The All-in-One Option

Medicare Advantage, or Part C, bundles your Medicare benefits into a single plan. These plans are offered by private insurers approved by Medicare and often include:

-

Hospital and Medical Coverage: Combining Parts A and B.

-

Extra Benefits: Such as vision, hearing, or dental coverage.

-

Prescription Drug Coverage: Often included, eliminating the need for a separate Part D plan.

Important Considerations

While Medicare Advantage can simplify your coverage, it’s important to:

-

Review the network of doctors and hospitals.

-

Understand copayments and out-of-pocket limits.

-

Evaluate how well the plan fits your specific healthcare needs.

Many Medicare Advantage plans provide integrated care options, streamlining access to specialists and reducing administrative burdens. They’re ideal if you prefer a one-stop solution for healthcare, but you should carefully weigh your options to ensure the plan aligns with your personal needs.

Medicare Part D: Prescription Drug Relief

Prescription medications can add up quickly, and that’s where Medicare Part D comes in. This standalone drug plan helps reduce the cost of:

-

Generic and brand-name drugs.

-

Medications for chronic conditions like diabetes or high blood pressure.

Key Features

-

Formularies: Each plan has a list of covered drugs, so check that your medications are included.

-

Pharmacy Networks: Using preferred pharmacies often lowers your costs.

-

Out-of-Pocket Cap: Starting in 2025, Part D has a $2,000 annual cap on drug expenses, providing significant financial relief.

By offering prescription drug coverage, Part D ensures that your medical treatment extends beyond the doctor’s office. This protection is especially valuable for individuals managing ongoing conditions requiring multiple medications. Familiarize yourself with the plan’s formulary and tier system to maximize savings.

How the Parts Work Together

Medicare Parts A, B, C, and D aren’t standalone silos—they often complement each other. Here’s how:

-

A + B: Basic hospital and outpatient coverage.

-

A + B + D: Adding Part D ensures your prescriptions are covered.

-

Part C: Bundles everything into one convenient package.

Using Parts A and B as a foundation allows you to build a custom coverage plan. Adding Part D or opting for Part C can streamline your healthcare experience, reducing stress and confusion. This flexibility ensures you can tailor your plan to fit your lifestyle and budget.

What About Supplemental Coverage?

If you’re worried about gaps in Medicare coverage, supplemental plans, often called Medigap, are an option. These plans help cover:

-

Deductibles.

-

Copayments.

-

Coinsurance.

While Medigap doesn’t replace Medicare Parts A and B, it can fill in financial gaps, giving you peace of mind. It’s a popular choice for those who prefer predictability in their healthcare costs, especially retirees on a fixed income.

Enrollment Periods You Need to Know

Timing is crucial when enrolling in Medicare. Missing key deadlines can lead to penalties. Here are the main enrollment periods:

Initial Enrollment Period (IEP)

Your IEP is a seven-month window that begins three months before you turn 65, includes your birthday month, and ends three months afterward. Signing up during this period ensures coverage starts promptly, avoiding delays.

General Enrollment Period (GEP)

If you miss your IEP, you can enroll from January 1 to March 31 each year. Coverage begins July 1, but penalties may apply. The GEP is a lifeline for those who need to get back on track with Medicare enrollment.

Annual Enrollment Period (AEP)

From October 15 to December 7, you can make changes to your Medicare coverage for the following year. Use this time to review plan changes and ensure your current plan still meets your needs.

Special Enrollment Periods (SEP)

Triggered by specific life events like moving or losing employer coverage, SEPs allow you to enroll or switch plans outside the standard periods. These life events often come with stressful transitions, so it’s good to know Medicare accommodates such changes.

Avoiding Common Medicare Pitfalls

Understanding Medicare is half the battle; avoiding missteps is the other half. Keep these tips in mind:

-

Review Your Options Annually: Plans change, and so do your needs.

-

Understand Coverage Limits: Know what each part covers and what it doesn’t.

-

Watch for Penalties: Late enrollment can lead to lifelong premium increases.

-

Use Preventive Services: Take advantage of screenings and vaccinations to stay healthy.

Planning ahead and staying informed ensures you’re not caught off guard by coverage gaps or unexpected costs. Medicare offers tools and resources to help you navigate options and avoid potential mistakes.

Protecting Both Health and Finances

Medicare’s four parts are more than just insurance; they’re tools to ensure your health needs are met without overwhelming your wallet. Understanding each part’s role lets you craft a plan that works for your unique circumstances. From hospital stays to prescription drugs, Medicare has you covered. By staying proactive and informed, you can make the most of your coverage while safeguarding your financial future.