Key Takeaways:

- Missing key Medicare enrollment dates in 2024 can result in delayed coverage or penalties, so mark your calendar now to avoid any setbacks.

- Understanding the different enrollment periods is essential for ensuring your Medicare coverage aligns with your health needs throughout the year.

Don’t Miss These Important Dates for Medicare Enrollment in 2024

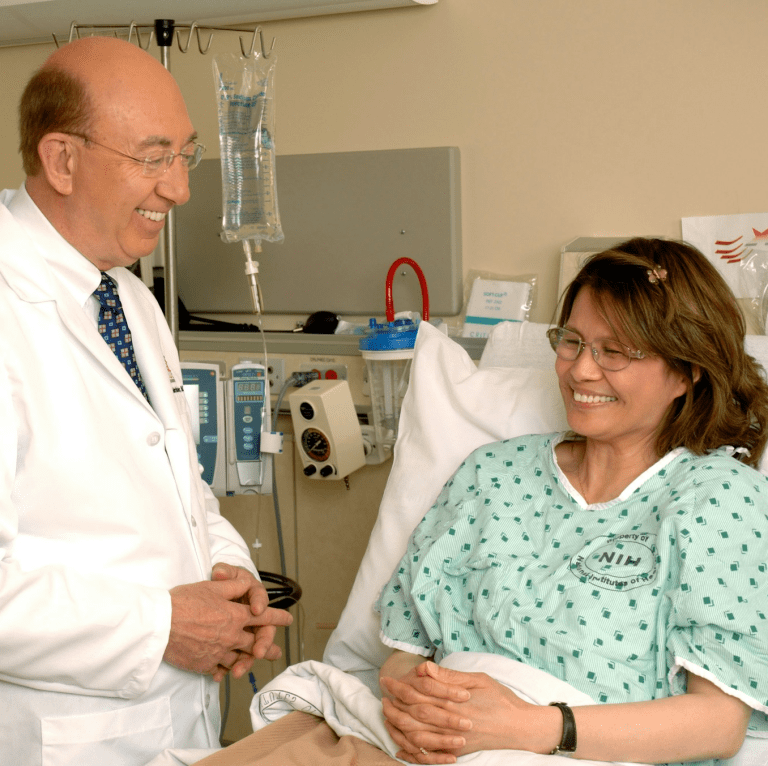

Medicare enrollment can be a daunting task, especially when it comes to keeping track of critical deadlines. For 2024, missing these dates could mean losing out on essential healthcare coverage, facing penalties, or experiencing delayed benefits. To avoid these pitfalls, it’s important to familiarize yourself with the different enrollment periods and what each entails. This guide will walk you through the key Medicare enrollment dates for 2024, ensuring you’re well-prepared to make informed decisions about your healthcare.

Initial Enrollment Period (IEP)

The Initial Enrollment Period (IEP) is the first opportunity for individuals to enroll in Medicare. This seven-month window begins three months before your 65th birthday, includes the month of your birthday, and ends three months after. For those turning 65 in 2024, it’s crucial to mark your calendar with this timeline to avoid any delays in coverage.

During the IEP, you can sign up for Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). Most people receive Part A without a premium, while Part B comes with a monthly premium. If you miss enrolling during the IEP, you may face late enrollment penalties, particularly for Part B. These penalties can increase your monthly premium by 10% for each 12-month period you were eligible but didn’t enroll.

Tip: If you’re already receiving Social Security benefits before turning 65, you’ll be automatically enrolled in Medicare Parts A and B. However, if you’re not receiving these benefits, you’ll need to actively sign up for Medicare.

General Enrollment Period (GEP)

If you missed your Initial Enrollment Period, the General Enrollment Period (GEP) is your next opportunity to enroll in Medicare. The GEP runs from January 1 to March 31 each year. During this time, you can sign up for Part A and Part B, but your coverage won’t start until July 1 of that year. Keep in mind that enrolling during the GEP may result in higher premiums due to late enrollment penalties.

The GEP is also an opportunity for those who previously declined Part B but have since changed their minds. However, be aware that penalties for late enrollment will still apply, and your coverage will be delayed until mid-year.

Important Note: For 2024, ensure you’re aware of any updates or changes to the General Enrollment Period. Staying informed can help you avoid unnecessary penalties or coverage delays.

Medicare Advantage Open Enrollment Period (MA OEP)

For those already enrolled in a Medicare Advantage (MA) plan, the Medicare Advantage Open Enrollment Period (MA OEP) offers a chance to make changes to your coverage. From January 1 to March 31, 2024, you can switch to another Medicare Advantage plan or return to Original Medicare (Part A and Part B). If you return to Original Medicare, you can also sign up for a Part D prescription drug plan during this time.

The MA OEP is particularly useful if you find that your current plan isn’t meeting your healthcare needs or if your plan’s network has changed. However, this period does not allow for switching from Original Medicare to a Medicare Advantage plan.

Pro Tip: Before making any changes during the MA OEP, review your current plan’s coverage, network, and formulary to ensure that your new choice aligns with your healthcare needs for 2024.

Special Enrollment Period (SEP)

Certain life events may qualify you for a Special Enrollment Period (SEP), allowing you to enroll in Medicare outside of the standard enrollment periods. These events can include losing employer-sponsored health coverage, moving out of your plan’s service area, or other specific circumstances.

The timing and duration of an SEP vary depending on the qualifying event. For example, if you lose employer coverage, you generally have eight months to sign up for Medicare Part B without facing a late enrollment penalty. Understanding the criteria and timeframes for SEPs is crucial for maintaining continuous coverage and avoiding penalties.

Reminder: SEPs are not automatic; you must proactively apply and provide proof of the qualifying event. Staying on top of these details will help you avoid gaps in your coverage.

Medicare Part D Enrollment Period

Medicare Part D, which provides prescription drug coverage, has its own set of enrollment rules. If you’re enrolling in Part D for the first time, you can do so during your Initial Enrollment Period (IEP). However, if you miss this window, you can sign up during the Annual Enrollment Period (AEP) or during a Special Enrollment Period if you qualify.

It’s important to enroll in a Part D plan as soon as you’re eligible because late enrollment can result in penalties. The penalty is calculated based on the number of months you were eligible for Part D but didn’t enroll, and it’s added to your monthly premium permanently.

For 2024, the Part D enrollment dates align with the Annual Enrollment Period, running from October 15 to December 7, 2024. During this time, you can enroll in a Part D plan or switch plans if your current coverage no longer meets your needs.

Quick Tip: Review the formulary of any Part D plan you’re considering to ensure that your medications are covered and that the plan’s network of pharmacies is convenient for you.

Annual Enrollment Period (AEP)

The Annual Enrollment Period (AEP), also known as the Medicare Open Enrollment Period, is a crucial time for all Medicare beneficiaries. From October 15 to December 7, 2024, you have the opportunity to review and make changes to your Medicare coverage. This includes switching from Original Medicare to a Medicare Advantage plan, changing Medicare Advantage plans, enrolling in a Part D prescription drug plan, or switching Part D plans.

Changes made during the AEP take effect on January 1 of the following year. This period is particularly important because it allows you to adjust your coverage based on changes in your health needs, financial situation, or updates to your plan’s benefits.

Essential Reminder: Even if you’re satisfied with your current coverage, it’s a good idea to review your plan during the AEP. Plan benefits and costs can change from year to year, and what worked for you in 2023 may not be the best option for 2024.

What Happens If You Miss an Enrollment Deadline?

Missing a Medicare enrollment deadline can have serious consequences, including gaps in coverage, late enrollment penalties, and delayed access to healthcare services. For example, if you miss your Initial Enrollment Period and don’t qualify for a Special Enrollment Period, you’ll need to wait until the General Enrollment Period to sign up, with coverage starting on July 1. During this gap, you may have to pay out-of-pocket for healthcare services.

Penalties can also add up over time. For instance, the Part B late enrollment penalty increases your monthly premium by 10% for each 12-month period you were eligible but didn’t enroll. This penalty is permanent and lasts for as long as you have Part B coverage.

Preventive Measure: The best way to avoid these issues is to mark your calendar with all relevant Medicare enrollment dates for 2024. Setting reminders a few weeks before each deadline can help ensure you don’t miss out on crucial enrollment opportunities.

Staying Informed and Prepared

Navigating Medicare enrollment can be challenging, especially with the various deadlines and penalties that can impact your coverage. Staying informed and prepared is key to avoiding costly mistakes. Regularly reviewing your Medicare options, understanding the different enrollment periods, and seeking assistance when needed can help you make the best decisions for your healthcare needs.

For 2024, it’s more important than ever to keep track of enrollment dates, especially as healthcare needs and plan options may change. Whether you’re enrolling for the first time or reviewing your current coverage, being proactive about Medicare enrollment will help you maintain the coverage you need without interruption.

Planning for the Future

As you approach Medicare enrollment in 2024, consider how your healthcare needs may evolve over the next year. Medicare is not a one-size-fits-all program, and your coverage should reflect your current health status, prescription needs, and financial situation. By staying on top of important dates and understanding your options, you can ensure that your Medicare coverage continues to meet your needs now and in the future.

Final Thoughts on Medicare Enrollment in 2024:

Missing key enrollment dates can have long-lasting effects on your healthcare coverage and finances. By staying informed and marking your calendar with these critical deadlines, you can avoid penalties, ensure continuous coverage, and select the plan that best meets your healthcare needs. Whether you’re new to Medicare or considering changes to your current plan, taking a proactive approach will help you navigate the complexities of Medicare enrollment with confidence.

Contact Information:

Email: [email protected]

Phone: 8175551234