Key Takeaways

- Medicare Advantage plans often come with unexpected costs that can impact your healthcare budget in retirement.

- Knowing what to look out for can help you make informed decisions and avoid surprises later.

What You Need to Know Before Choosing a Medicare Advantage Plan

When you first dive into Medicare options, Medicare Advantage plans might seem like an appealing choice. These plans promise bundled coverage, often including extras like dental or vision. However, there’s more than meets the eye. Let’s explore the hidden costs retirees often overlook when choosing these plans—and why it’s essential to read the fine print before committing.

Monthly Premiums Are Just the Start

Understanding Basic Costs

While you may be familiar with monthly premiums for healthcare coverage, the true cost of a Medicare Advantage plan can go far beyond this number. Some plans lure you in with seemingly low premiums, but that’s just one piece of the puzzle.

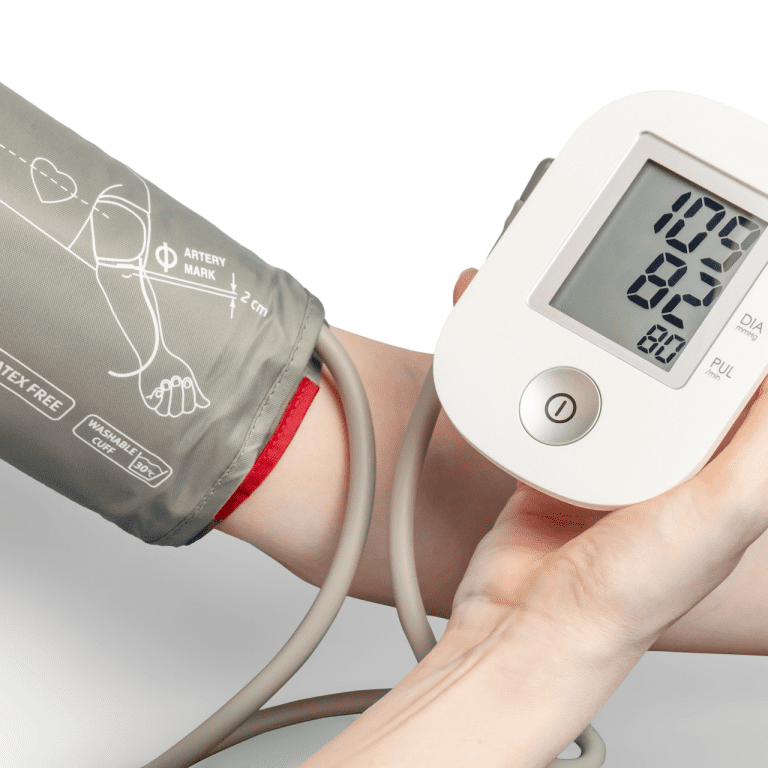

The Ripple Effect of Out-of-Pocket Costs

Under Medicare Advantage, out-of-pocket costs like copayments, coinsurance, and deductibles can add up quickly. Even routine visits to your doctor might require a copayment. Need a specialist? Expect even higher costs. This becomes especially significant if you face unexpected health issues, as expenses can snowball with frequent visits or specialized treatments.

Network Limitations Could Cost You More

The Hidden Catch of Provider Networks

Most Medicare Advantage plans operate within specific provider networks, meaning you can only see certain doctors or use specific hospitals without facing higher costs. These networks can be restrictive, and going out of network often comes with hefty charges.

Emergencies Aren’t Exempt

You might assume emergencies are covered regardless of the provider, but the reality is more nuanced. Many plans have rules about what constitutes an “emergency” and who can provide care. This could leave you footing the bill for significant medical expenses if you find yourself needing out-of-network care.

Supplemental Benefits Aren’t Always Free

Extras That Sound Great—But Have Limits

Medicare Advantage plans often tout additional benefits like gym memberships, dental care, or hearing aids. But these benefits often come with caps or limitations. For instance, while your plan might cover dental checkups, major procedures like root canals could still cost you significantly.

Weighing the Value of “Extras”

These extras are only valuable if they align with your needs. A plan might offer a gym membership you never use or vision coverage with a limited selection of providers, forcing you to pay out of pocket elsewhere.

Prescription Costs Can Sneak Up on You

Formularies and Tiers

Prescription drug coverage under Medicare Advantage plans follows a formulary—a list of covered drugs organized into tiers. Medications on higher tiers often require higher copayments or coinsurance, and not all your prescriptions may be covered.

The Donut Hole Gap

Although the Medicare Part D “donut hole” has been shrinking, you may still face increased costs after reaching a certain spending threshold. If you require expensive medications, these costs can pile up quickly, especially with a Medicare Advantage plan.

Annual Out-of-Pocket Maximums Aren’t as Reassuring as They Seem

The Cap Isn’t Always Comprehensive

Medicare Advantage plans feature an annual out-of-pocket maximum, which might seem like a safety net. However, this cap applies only to costs covered by the plan. Expenses like out-of-network care, uncovered treatments, or services exceeding benefit limits aren’t included.

What Happens If You Hit the Limit?

Once you hit the cap, your plan might cover 100% of additional costs for the rest of the year—but only for in-network services. It’s essential to understand what your maximum includes and excludes to avoid surprises.

Geographic Restrictions Could Affect Your Coverage

Not All Plans Travel With You

Many Medicare Advantage plans are geographically restricted, meaning coverage is limited to a specific service area. If you travel often or split your time between different states, this could become a significant issue.

Seasonal Moves and Snowbirds Beware

Retirees who spend part of the year in another state may find themselves out of network. While some plans offer national coverage options, they often come at a higher cost or reduced benefits.

Prior Authorizations Add Another Layer of Complexity

Delays and Denials

Medicare Advantage plans often require prior authorization for certain procedures, treatments, or medications. This can delay your care or, in some cases, lead to outright denials.

The Time Factor

Obtaining prior authorization isn’t always quick. In urgent situations, this can be incredibly stressful and could delay critical treatments or lead to unexpected out-of-pocket costs if you proceed without approval.

How to Prepare for the Hidden Costs

Read the Fine Print

Before enrolling in any Medicare Advantage plan, thoroughly review the plan’s Evidence of Coverage (EOC) document. This outlines all costs, including premiums, copayments, and coinsurance.

Assess Your Healthcare Needs

Think about your current and future medical needs. Do you have a chronic condition requiring frequent doctor visits? Are you on multiple prescriptions? Understanding your needs can help you select a plan that minimizes surprises.

Compare Plans Carefully

Take advantage of online tools or work with a Medicare advisor to compare plans side by side. Look beyond premiums to consider total costs, network restrictions, and coverage limits.

Is Medicare Advantage the Right Choice for You?

Medicare Advantage plans can be a great option for some, but they’re not for everyone. If you’re looking for comprehensive, predictable coverage, you might find that Original Medicare combined with a Medigap plan suits your needs better.

Avoiding Costly Surprises

Understanding the hidden costs of Medicare Advantage plans is the first step in making an informed decision about your healthcare in retirement. By examining the fine print, assessing your needs, and considering all potential expenses, you can choose a plan that fits your budget and lifestyle without unexpected surprises.