Key Takeaways

-

Medicare Part B helps cover medical costs like doctor visits, outpatient care, and certain preventive services, making it a critical part of your health coverage.

-

Understanding what Medicare Part B does and does not cover in 2025 can help you avoid costly surprises and better plan your healthcare budget.

Understanding What Medicare Part B Actually Covers

When it comes to managing ongoing healthcare needs in 2025, Medicare Part B plays a central role. While Medicare Part A focuses on hospital stays, Part B is your go-to for everyday medical services.

Here’s what Medicare Part B generally covers:

-

Visits to doctors and specialists

-

Outpatient medical services

-

Preventive care, including screenings and vaccines

-

Durable medical equipment like walkers and wheelchairs

-

Laboratory tests and imaging

-

Mental health outpatient care

These services are vital for chronic condition management, early detection of diseases, and maintaining long-term health.

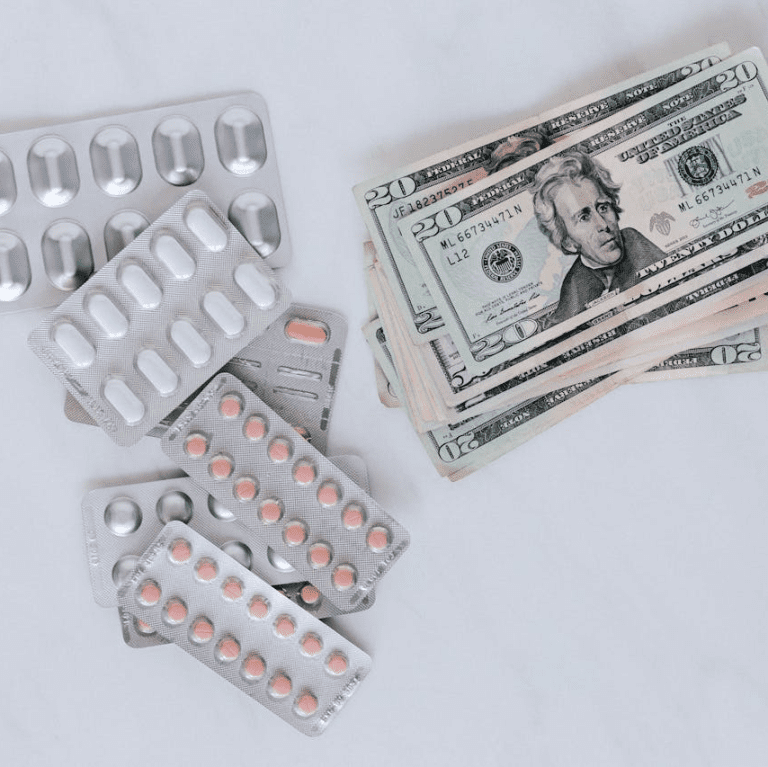

What You’ll Pay in 2025

Even though Medicare Part B covers a wide range of services, you still have some out-of-pocket responsibilities. For 2025, here’s what you need to be prepared for:

-

Standard monthly premium: $185

-

Annual deductible: $257

-

Coinsurance: Typically 20% of the Medicare-approved amount for most services

You’ll need to meet the annual deductible before coinsurance kicks in. The 20% coinsurance can add up quickly, especially for frequent outpatient visits or costly diagnostics.

Enrollment Timing Matters

Knowing when to enroll in Medicare Part B is critical. Missing the right window can lead to penalties and delayed coverage.

Initial Enrollment Period (IEP)

-

Starts 3 months before your 65th birthday

-

Includes the month of your birthday

-

Ends 3 months after your birthday month

General Enrollment Period (GEP)

-

Runs January 1 to March 31 each year

-

Coverage starts July 1 of the same year

Special Enrollment Period (SEP)

If you’re still working past 65 and have employer coverage, you may qualify for a Special Enrollment Period. This usually extends 8 months after employment or coverage ends.

Penalties Can Follow You for Life

Failing to enroll in Medicare Part B when you’re first eligible can result in late enrollment penalties. In 2025, the penalty is calculated as 10% for each 12-month period you were eligible but didn’t sign up.

This penalty is added to your monthly premium permanently, so enrolling on time can save you a significant amount over the long run.

What Medicare Part B Does Not Cover

Medicare Part B is valuable, but it doesn’t cover everything. You’ll need to plan for these gaps:

-

Prescription drugs (covered separately under Part D)

-

Routine dental, vision, and hearing care

-

Long-term custodial care

-

Most cosmetic procedures

To cover these additional services, many people consider enrolling in other Medicare options, but those choices require separate enrollment and may involve additional costs.

Preventive Services: No Cost Sharing

One of the major benefits of Medicare Part B is its preventive care coverage. Many of these services come at no additional cost to you, as long as the provider accepts Medicare assignment.

Common preventive services include:

-

Cardiovascular screenings

-

Mammograms

-

Flu and COVID-19 vaccines

-

Colorectal cancer screenings

-

Diabetes screenings

Getting these services regularly helps detect problems early and may reduce your long-term medical expenses.

How Part B Works with Other Coverage

If you have other forms of insurance—such as through a spouse’s employer or military benefits—Medicare Part B may act as your secondary or primary payer depending on the situation.

-

Employer insurance (20+ employees): Group plan pays first, Medicare second

-

Employer insurance (<20 employees): Medicare pays first

-

TRICARE or VA benefits: Medicare coordination rules vary

It’s essential to understand how your existing coverage interacts with Part B to avoid billing issues and denied claims.

Delaying Part B: When It’s Okay and When It’s Not

You can delay Medicare Part B enrollment without penalty only if you have creditable coverage from an employer plan.

But beware:

-

COBRA is not creditable coverage

-

Retiree health plans may not count

Always check with your benefits administrator to confirm whether your coverage meets the criteria. If not, delaying Part B could trigger penalties.

Getting Help with Out-of-Pocket Costs

If the 20% coinsurance or the monthly premiums are difficult to afford, you may qualify for financial assistance programs in 2025. These include:

-

Medicare Savings Programs (MSPs) to help with premiums and cost-sharing

-

Extra Help for prescription drug costs

-

Medicaid if your income and resources are low enough

Each program has specific eligibility rules, and applying can take time. If you think you might qualify, it’s best to start the process early.

Changes to Be Aware of in 2025

Each year, Medicare updates its coverage, premiums, and deductibles. In 2025:

-

Premiums have increased to $185 per month

-

Deductibles now stand at $257

-

More preventive screenings may be available

-

Telehealth flexibility continues, allowing virtual visits to remain a covered service under Part B

Staying updated on these changes ensures you get the most from your coverage.

Steps to Take Before You Enroll

Here’s how you can prepare for Medicare Part B enrollment in 2025:

-

Review your current health coverage

-

Compare costs and benefits of enrolling in Part B now versus later

-

Understand how it fits with other parts of Medicare

-

Check if you qualify for any financial assistance

-

Mark your calendar for your Initial Enrollment Period

Being proactive prevents delays and helps you avoid unexpected bills.

Why You Shouldn’t Ignore Part B

Skipping Medicare Part B might seem like a cost-saving move in the short term, but it usually results in larger bills down the road. The coverage is designed to protect you from high medical costs due to:

-

Ongoing doctor visits

-

Outpatient surgeries

-

Unexpected injuries

-

Emergency department follow-ups

Even if you’re healthy now, having Part B ensures you’re protected when something does come up.

Planning Now Saves Money Later

Medicare Part B is more than just a monthly bill—it’s your safety net for staying healthy and catching issues early. Make sure you:

-

Understand what it covers

-

Know when to enroll

-

Prepare for out-of-pocket costs

-

Explore financial help if needed

If you’re unsure how it all applies to you, get in touch with a licensed agent listed on this website for personalized guidance.