Key Takeaways

-

Medicare helps with many medical expenses in retirement, but it doesn’t cover everything. You should be prepared for premiums, deductibles, copayments, and services Medicare doesn’t include.

-

Healthcare costs have steadily risen, and in 2025, many retirees are feeling the financial strain, even with Medicare. Without careful planning, out-of-pocket costs can seriously erode your retirement savings.

The Illusion of Medicare as a Safety Net

You might expect Medicare to shield you from high healthcare costs once you retire. After all, it’s a federal program designed to cover older adults. But while Medicare plays a critical role in your health coverage, it doesn’t eliminate all your financial exposure.

Medicare consists of multiple parts: Part A (hospital insurance), Part B (medical insurance), Part D (prescription drug coverage), and optionally, Part C (Medicare Advantage). Each of these components has its own cost-sharing rules. And unless you qualify for full Medicaid or a low-income subsidy, you’re responsible for premiums, deductibles, and coinsurance.

Costs That Add Up Quickly

Part A Costs

If you paid Medicare taxes for at least 40 quarters, Part A has no monthly premium. But the hospital deductible in 2025 is $1,676 per benefit period. After 60 days, you start paying daily coinsurance. For days 61 to 90, you owe $419 per day, and after 90 days, you use your 60 lifetime reserve days at $838 per day.

Skilled nursing facility care also brings coinsurance after 20 days. From day 21 to 100, your cost is $209.50 per day.

Part B Costs

In 2025, the standard Part B premium is $185 per month. High-income earners pay more due to IRMAA (Income-Related Monthly Adjustment Amount).

You also face an annual deductible of $257. After meeting it, Medicare covers 80% of approved services, leaving you to pay 20% coinsurance with no out-of-pocket cap.

That 20% can become a major burden if you need frequent specialist visits, lab tests, durable medical equipment, or outpatient surgery.

Part D Costs

Prescription drug costs are a significant concern. In 2025, the Part D deductible can be as high as $590. After that, you pay a portion of drug costs until your out-of-pocket spending hits $2,000. That’s the new annual cap introduced this year, but reaching that cap still means hundreds or even thousands out of your pocket first.

Keep in mind that not all medications are covered, and some drugs have prior authorization requirements or higher tiers.

Commonly Overlooked Expenses

Even with all major parts of Medicare, you can still face gaps that catch you off guard.

-

Dental, Vision, and Hearing Care: Original Medicare doesn’t cover routine dental cleanings, eyeglasses, or hearing aids. You’d need to pay out of pocket or seek additional coverage.

-

Long-Term Care: Medicare doesn’t cover most long-term custodial care in nursing homes or assisted living. This is one of the largest financial risks retirees face.

-

Emergency Services Abroad: Travel outside the U.S.? Medicare typically doesn’t pay for foreign medical care, even in emergencies.

-

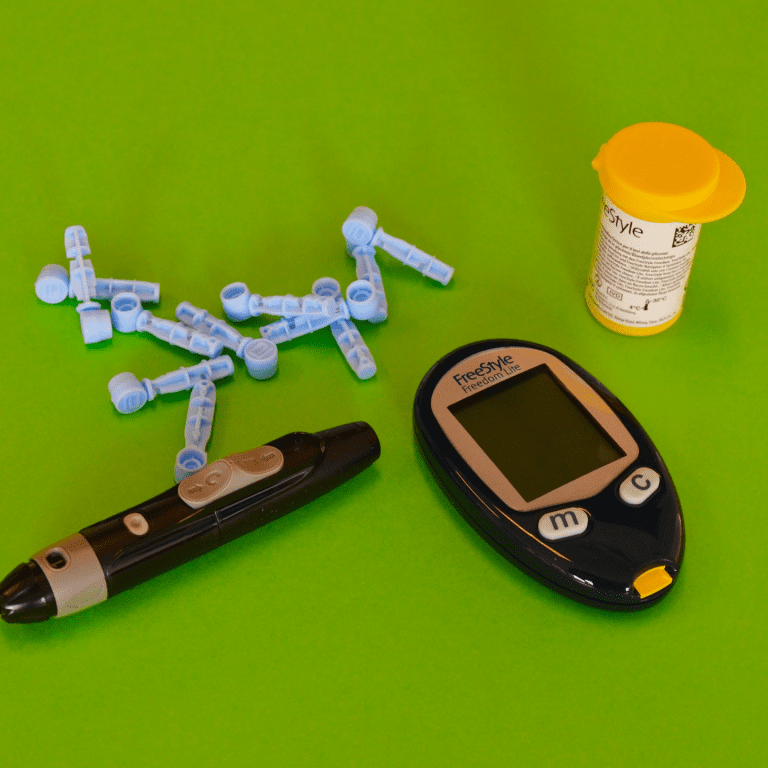

Medical Supplies: Items like incontinence supplies, over-the-counter medications, or diabetic foot care products may not be covered.

-

Mental Health: While Medicare Part B includes outpatient mental health services, you’ll still pay 20% coinsurance. Telehealth is covered, but in-person visits are required at least once every 12 months starting in October 2025.

How Costs Have Changed Over Time

Healthcare inflation doesn’t stop at retirement. Medicare costs have steadily risen:

-

From 2020 to 2024, the Part B premium increased from $144.60 to $174.70, and now sits at $185 in 2025.

-

The Part A deductible rose from $1,408 in 2020 to $1,676 in 2025.

-

Part D’s out-of-pocket cost structure changed significantly in 2025, introducing the $2,000 cap. But this came with higher plan deductibles and less generous initial coverage phases.

If this trend continues, you can expect your healthcare budget to keep expanding during retirement, even if your income stays flat.

Why Retirees Feel the Pressure More in 2025

Several factors have intensified the cost burden this year:

-

Higher Cost of Living: Inflation in housing, food, and energy reduces the flexibility in fixed retirement budgets.

-

Rising Medicare Premiums: Even standard premium increases for Parts B and D cut into monthly cash flow.

-

Prescription Drug Spending: While the $2,000 cap is a step forward, many drugs now cost more upfront. Some medications have shifted to higher tiers, increasing coinsurance or copays.

-

Service Access Limitations: Delays in appointments, limited provider networks, and administrative hurdles make timely care harder to access.

-

Limited Savings Growth: Many retirees invested conservatively and are now seeing returns that barely keep up with inflation.

Medicare Doesn’t Have an Out-of-Pocket Maximum

Original Medicare has no annual cap on your total out-of-pocket expenses. Unlike many employer or private plans, there’s no safety net once you’ve spent a certain amount.

This means if you have a serious illness requiring frequent outpatient treatment, hospitalizations, or expensive diagnostic procedures, you could pay tens of thousands over the course of a year.

To help reduce this risk, many retirees consider purchasing a Medigap (Medicare Supplement) policy or enrolling in a Medicare Advantage plan. However, these options also come with costs, networks, and coverage limits.

Yearly Budgeting for Healthcare in Retirement

As of 2025, many experts recommend that individuals budget $5,000 to $6,500 per year for healthcare costs in retirement. This figure includes premiums, cost-sharing, and uncovered services but not long-term care.

If you have chronic conditions, that estimate can rise to $8,000 or more annually.

A few strategies to consider:

-

Factor in Inflation: Use a 5% healthcare inflation rate when projecting future costs.

-

Plan for Spousal Coverage: If both you and your spouse are on Medicare, double your budget estimates.

-

Use HSAs Wisely: If you have a Health Savings Account from before Medicare enrollment, those funds can be used tax-free for qualified expenses.

-

Review Annual Notices: Each fall, check your plan’s Annual Notice of Changes to catch premium hikes, deductible changes, or formulary shifts.

Choosing the Right Medicare Strategy for Your Budget

To control healthcare spending in retirement, you need a plan that fits your unique health and financial profile.

Some questions to consider:

-

Are you willing to pay higher premiums for more predictable out-of-pocket costs?

-

How much risk can your budget tolerate if you have a serious illness?

-

Do you want access to any provider who accepts Medicare, or are you okay with network restrictions?

-

Do you take multiple prescription medications regularly?

Answering these can help you compare the pros and cons of different Medicare pathways, such as pairing Original Medicare with a Medigap plan or enrolling in a Medicare Advantage plan.

What You Can Do Now

Here are proactive steps to take now in 2025 to better manage your Medicare-related costs:

-

Create a Medicare Expense Tracker: Keep records of premiums, copays, and uncovered bills. It helps you analyze where your money is going.

-

Schedule an Annual Medicare Review: Use Medicare Open Enrollment (October 15 to December 7) to assess if your current plan still meets your needs.

-

Check for Low-Income Programs: Look into Extra Help for prescription drug costs or Medicare Savings Programs if your income is limited.

-

Talk to a Licensed Agent: A licensed agent listed on this website can help you evaluate your options and find a strategy aligned with your budget and coverage priorities.

Don’t Let Rising Healthcare Costs Derail Your Retirement

Retirement should be about enjoying your time, not stressing over medical bills. But in 2025, the reality is that Medicare only goes so far. The program covers a lot, but not everything, and gaps in coverage can strain even a well-planned retirement.

Now is the time to understand your benefits, prepare for expected and unexpected costs, and choose coverage that supports your health and financial security.

If you need help reviewing your Medicare plan or want to explore options to reduce your healthcare expenses, speak with a licensed agent listed on this website for expert guidance.