Key Takeaways

-

Medicare eligibility is primarily based on age, but other factors such as disability and certain medical conditions can qualify you earlier.

-

Understanding enrollment periods and requirements ensures you get the coverage you need without facing penalties or coverage gaps.

Who Can Get Medicare? Understanding Eligibility Basics

Medicare is a vital program that provides health coverage for millions of Americans, but qualifying for it isn’t always as simple as turning a certain age. Whether you’re approaching eligibility or wondering if you qualify earlier, it’s essential to understand the rules surrounding enrollment. Let’s break it all down so you know exactly where you stand.

Standard Medicare Eligibility: Turning 65 and What It Means

The most common way to qualify for Medicare is by reaching age 65. If you or your spouse have worked and paid Medicare taxes for at least 10 years (40 quarters), you are generally eligible for premium-free Medicare Part A and can enroll in Part B by paying a monthly premium.

What Happens When You Turn 65?

-

You become eligible for Medicare starting the first day of the month you turn 65.

-

If your birthday falls on the first of the month, your eligibility actually starts the month before you turn 65.

-

You can sign up during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday month and extends three months after.

If you already receive Social Security or Railroad Retirement Board (RRB) benefits at least four months before you turn 65, you will be automatically enrolled in Medicare Parts A and B. If not, you’ll need to sign up yourself through the Social Security Administration.

Qualifying for Medicare Before Age 65

Not everyone has to wait until age 65 to get Medicare. You may qualify earlier if you meet certain conditions. Let’s explore those situations.

Disability-Based Medicare Eligibility

If you have been receiving Social Security Disability Insurance (SSDI) for at least 24 months, you automatically qualify for Medicare, regardless of age. This two-year waiting period applies to most disability recipients, but once you pass it, you’re eligible for both Part A and Part B coverage.

Medicare for End-Stage Renal Disease (ESRD) and ALS

Some medical conditions allow you to bypass the typical waiting periods:

-

End-Stage Renal Disease (ESRD): If you have kidney failure and require regular dialysis or a kidney transplant, you may qualify for Medicare at any age. Coverage usually begins the first day of the fourth month of dialysis treatments or sooner if you receive a kidney transplant.

-

Amyotrophic Lateral Sclerosis (ALS, or Lou Gehrig’s disease): If you are diagnosed with ALS, you automatically qualify for Medicare as soon as your disability benefits begin—there’s no waiting period.

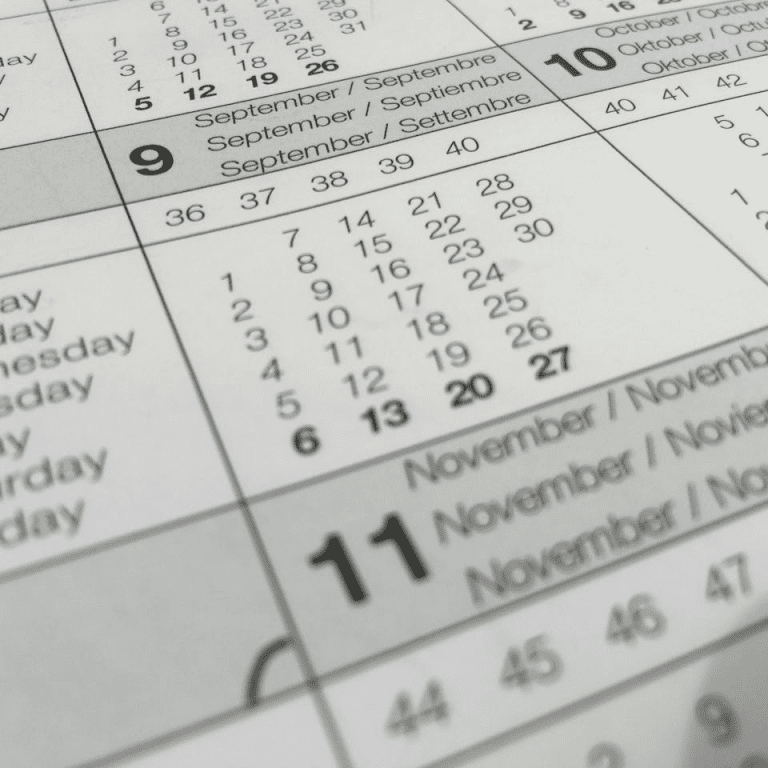

Understanding Medicare Enrollment Periods

Missing your enrollment window can result in penalties or delayed coverage, so it’s crucial to be aware of the key periods when you can sign up.

Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) lasts seven months, including the three months before, the month of, and the three months after you turn 65. This is your first opportunity to sign up for Medicare.

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you can enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, coverage doesn’t start until July 1, and you may have to pay late penalties.

Special Enrollment Period (SEP)

If you or your spouse are still working and have employer-provided health insurance, you may qualify for a Special Enrollment Period (SEP), which allows you to enroll in Medicare without penalty once your employer coverage ends.

Do You Need to Sign Up for Medicare at 65?

Your need to sign up at 65 depends on your current situation:

-

If you already receive Social Security or RRB benefits, you’ll be automatically enrolled in Medicare Parts A and B.

-

If you are still working and have employer-sponsored coverage, you may be able to delay enrolling in Part B without facing a late penalty.

-

If you don’t have employer coverage, you should sign up during your Initial Enrollment Period to avoid gaps and late fees.

Even if you delay Part B, it’s a good idea to enroll in Medicare Part A, since it’s usually premium-free for most people.

Understanding Medicare Costs: Premiums, Deductibles, and Co-Pays

Medicare Part A Costs

-

Premiums: Most people qualify for premium-free Part A, but if you haven’t paid enough Medicare taxes, you may owe a monthly premium.

-

Deductible: In 2025, the inpatient hospital deductible is $1,676 per benefit period.

-

Coinsurance: You’ll owe a daily coinsurance fee for hospital stays beyond 60 days.

Medicare Part B Costs

-

Premium: The standard Part B monthly premium in 2025 is $185.

-

Deductible: The annual deductible is $257.

-

Co-Pays: After meeting your deductible, you typically pay 20% of Medicare-approved services.

Medicare Part D (Prescription Drug Coverage) Costs

-

Deductible: The maximum deductible in 2025 is $590.

-

Out-of-Pocket Cap: Once your out-of-pocket spending reaches $2,000, you won’t pay anything for covered prescription drugs for the rest of the year.

What If You Delay Enrollment?

Delaying Medicare enrollment can have consequences.

-

Part A: No penalty if you qualify for premium-free Part A, but if you have to pay for it, enrolling late may increase your monthly premium.

-

Part B: If you don’t sign up during your IEP and don’t qualify for a Special Enrollment Period, your monthly premium may increase by 10% for each full year you delay enrollment.

-

Part D: If you go 63 days or more without drug coverage, you could face a permanent late enrollment penalty.

Final Thoughts on Medicare Eligibility and Enrollment

Understanding when and how you qualify for Medicare can save you from penalties, coverage gaps, and unnecessary stress. Whether you qualify based on age, disability, or a specific health condition, it’s essential to enroll at the right time to ensure seamless coverage. If you’re approaching eligibility, take the time to review your options and determine the best path for your healthcare needs.