Key Takeaways

-

Even the best-rated Medicare Advantage plans can come with hidden or misunderstood costs that may not appear upfront.

-

CMS star ratings help evaluate quality, but they do not guarantee lower out-of-pocket costs or full coverage across all services.

What Makes a Medicare Advantage Plan Look Good at First Glance

Medicare Advantage plans are popular for their added benefits and extra coverage compared to Original Medicare. Many of these plans offer perks such as routine dental and vision services, gym memberships, and care coordination. Some even include prescription drug coverage. These features can make them highly attractive, especially when you first compare benefits during enrollment.

A major factor many people look at is the Centers for Medicare & Medicaid Services (CMS) star rating. These ratings, from 1 to 5 stars, reflect the overall performance of a plan based on measures like customer service, managing chronic conditions, and member experience. A 4- or 5-star plan is often seen as “one of the best.”

However, the features and ratings do not tell the full story when it comes to your actual cost burden throughout the year.

When Added Benefits Distract from Core Coverage

It’s easy to be drawn to the extras. Over-the-counter allowances, wellness incentives, and hearing aids can add value, but they do not necessarily offset gaps in medical or hospital coverage. This becomes especially important when you have complex or chronic health needs.

While routine services are attractive, the true worth of a plan lies in how well it covers serious medical events or ongoing treatment. You may be paying less on paper while absorbing more cost out-of-pocket in practice.

CMS Star Ratings Have Their Limits

CMS star ratings are useful for comparing plan quality, but they do not directly assess affordability. A plan can be rated 5 stars and still come with:

-

Higher deductibles for hospitalization

-

Narrow provider networks

-

Steep copays for specialists or urgent care

-

Limited drug formulary choices

The rating system focuses heavily on preventive care, member surveys, and chronic condition management. While these are important indicators of overall value, they don’t tell you how much you might spend during a year of frequent doctor visits or prescription drug needs.

What You Might Actually Be Paying

The real cost of a Medicare Advantage plan comes in several forms:

-

Monthly premiums: Although some plans advertise low or no monthly premiums, many still require the standard Medicare Part B premium, which in 2025 is $185.

-

Deductibles: Some plans require you to meet a deductible before coverage begins for certain services.

-

Copayments: You might pay $20 to $75 for each primary care or specialist visit, and more for emergency or urgent care.

-

Coinsurance: This percentage-based charge can apply to outpatient procedures, durable medical equipment, or even hospitalization.

-

Out-of-pocket maximums: In 2025, this can be as high as $9,350 for in-network services, and up to $14,000 when including out-of-network care.

You may not feel the impact during your first few visits, but costs can add up quickly with surgeries, diagnostic tests, or frequent specialist consultations.

Network Restrictions Could Limit Your Choices

One of the most overlooked factors in Medicare Advantage plans is the provider network. Many of the highest-rated plans operate within narrow networks, meaning you must use specific doctors or facilities to get covered care.

If you go out of network, you might be responsible for most or all of the cost. This can be a major concern if:

-

You travel frequently or split your time between states

-

Your specialist is not included in the plan

-

Local hospitals or major centers are excluded

Before enrolling, it’s essential to verify whether your current doctors, clinics, and pharmacies are within the network.

Prescription Drug Coverage Isn’t Always Comprehensive

While many Medicare Advantage plans include prescription drug coverage (Part D), the formulary—or list of covered drugs—varies widely. Just because a plan includes drug coverage doesn’t mean your medications are included or affordable.

In 2025, Medicare Part D introduces a $2,000 annual cap on out-of-pocket drug costs, which is a significant benefit. However, how you reach that cap, and how your plan covers drugs before and after that point, still varies.

Important considerations include:

-

Which tier your medications fall under

-

Whether prior authorization is needed

-

If the pharmacy you use is in-network

Some plans have preferred mail-order services or limit access to specialty drugs.

Hidden Costs with Referrals and Authorizations

Many Medicare Advantage plans require referrals to see specialists. You may need to get approval from your primary care doctor first, and in some cases, the plan itself must authorize a service before it will be covered.

This process can delay necessary care or lead to unexpected denials. If a referral or authorization is missed, you could end up paying the full cost of the service, even if it would normally be covered.

Check the following:

-

Does the plan require referrals for all specialties?

-

Are authorizations needed for diagnostic imaging or outpatient surgery?

-

What is the turnaround time for authorization decisions?

Knowing these policies ahead of time can help you avoid surprise bills.

Emergency and Urgent Care Away from Home

Another common gap is how Medicare Advantage plans handle care outside your usual service area. While emergency care is typically covered nationwide, urgent care or follow-up visits may not be.

For snowbirds or frequent travelers, this can present challenges. Some plans offer travel coverage or reciprocal network access, but many do not. If your plan doesn’t have provisions for out-of-area services, you might pay full price for urgent care or be forced to return home for treatment.

Always review the plan’s policies on:

-

Emergency services

-

Out-of-area urgent care

-

Temporary stays in another state

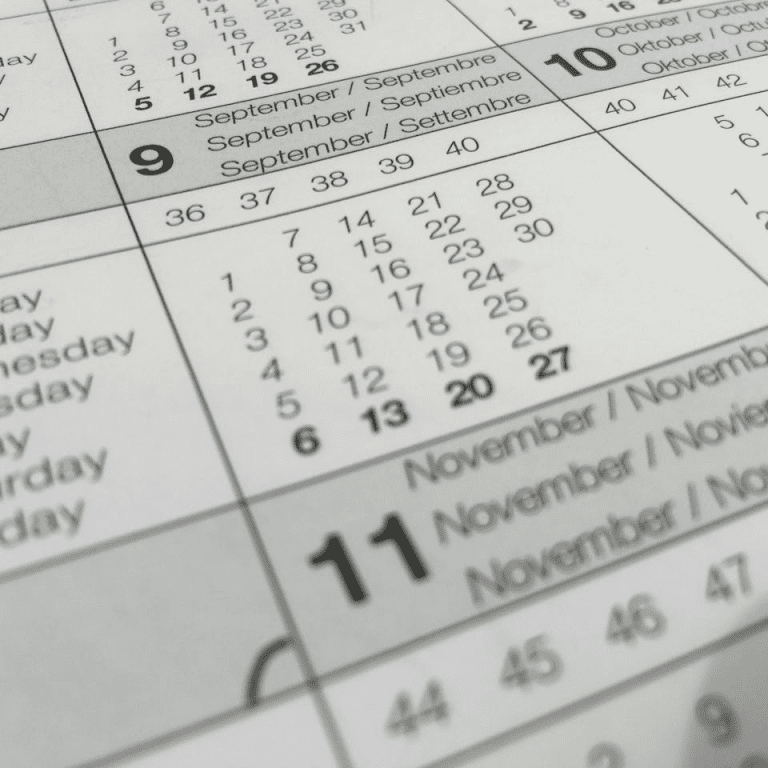

Timing Can Affect Your Access to the Best Plans

Medicare Advantage plans can only be changed during certain times of the year:

-

Initial Enrollment Period (IEP): The 7-month window around your 65th birthday

-

Annual Enrollment Period (AEP): October 15 to December 7

-

Medicare Advantage Open Enrollment Period (MA OEP): January 1 to March 31, but only if you’re already in a Medicare Advantage plan

Outside of these periods, changes can only be made during a Special Enrollment Period triggered by a life event, such as moving or losing coverage.

If you find out too late that your plan isn’t meeting your needs, you may have to wait months before switching.

Evaluate Carefully Before Enrolling

Medicare Advantage plans are not one-size-fits-all. A highly-rated plan may look excellent on paper but still come with limitations that don’t fit your situation. To make the right choice, consider:

-

Your current healthcare usage

-

Prescription medications and their formulary status

-

Specialist access and referral policies

-

Preferred hospitals and provider networks

-

Travel needs and out-of-area care

Use CMS tools to compare plans, but also review the Summary of Benefits and Evidence of Coverage documents for each plan. These documents outline all costs, authorizations, and service restrictions in detail.

Why Star Ratings Aren’t Everything

A CMS star rating is a helpful indicator of general plan quality. However, it does not replace personalized evaluation. A plan with 3.5 stars might work better for your needs than a 5-star plan if it covers your doctors, offers lower copays for your medications, or doesn’t require as many referrals.

Keep in mind that ratings can change annually based on performance. A plan rated highly today could drop a star next year.

You Have Options and Resources

If you’re feeling overwhelmed by Medicare Advantage choices, you are not alone. Many enrollees struggle to evaluate their options thoroughly. That’s where expert support can help.

Speaking to a licensed agent listed on this website can offer personalized help tailored to your health and financial situation. A good agent can walk you through your current coverage, explore alternatives, and make sure you’re not missing anything that could save you time, money, or stress.

Understanding What You’re Really Signing Up For

Medicare Advantage plans can offer significant value when they align well with your individual health needs and expectations. But some of the best-rated plans can also carry more financial risk than you realize, especially if you focus too much on extras and overlook core coverage limitations.

Don’t make your decision based only on ratings or initial benefits. Review the full cost structure, network details, drug coverage, and referral requirements. Then get in touch with a licensed agent listed on this website to make sure you’re choosing a plan that works for you, not just the average member.