Key Takeaways

- Understanding the basics of Medicare and its parts is crucial for making informed decisions during the enrollment period.

- Planning ahead and knowing when and how to enroll can help you avoid common mistakes and ensure you get the coverage you need.

Getting Ready to Sign Up for Medicare? Here’s a Friendly Guide to Help You Through the Enrollment Period

Navigating the Medicare enrollment process can feel overwhelming, especially if you’re doing it for the first time. With multiple parts, timelines, and options to consider, it’s easy to get confused. But don’t worry—this guide is here to help you break down the process step by step, so you can make informed decisions with confidence.

What’s Medicare All About?

Medicare is a federal health insurance program primarily for people aged 65 and older, though certain younger individuals with disabilities or specific conditions may also qualify. The program is designed to help cover the costs of healthcare, including hospital stays, doctor visits, and other medical services. Understanding the basic structure of Medicare is the first step in getting ready for enrollment.

Medicare is divided into four main parts:

-

Medicare Part A (Hospital Insurance): This part covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don’t pay a premium for Part A because they or their spouse paid Medicare taxes while working.

-

Medicare Part B (Medical Insurance): Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Unlike Part A, Part B typically requires a monthly premium.

-

Medicare Part C (Medicare Advantage): Offered by private companies, Part C includes all the benefits and services covered under Parts A and B, often with additional coverage like vision, hearing, dental, and wellness programs. Some plans may also include prescription drug coverage.

-

Medicare Part D (Prescription Drug Coverage): This part helps cover the cost of prescription drugs. Part D plans are offered by private insurance companies approved by Medicare.

Understanding these parts will help you choose the right coverage based on your healthcare needs.

When’s the Best Time to Sign Up?

Timing is crucial when it comes to enrolling in Medicare. Knowing when to sign up can help you avoid penalties and ensure you have the coverage you need when you need it.

Initial Enrollment Period (IEP)

The Initial Enrollment Period is a seven-month window that begins three months before you turn 65, includes your birthday month, and ends three months after. This is the best time to sign up if you’re new to Medicare because it guarantees that your coverage will start as soon as you’re eligible.

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you can sign up during the General Enrollment Period, which runs from January 1 to March 31 each year. However, your coverage won’t begin until July 1, and you may have to pay higher premiums for late enrollment.

Special Enrollment Period (SEP)

The Special Enrollment Period is available if you delayed Medicare enrollment because you were covered by an employer’s health plan. This period typically lasts for eight months after your employment or coverage ends, allowing you to sign up for Medicare without facing penalties.

Breaking Down the Different Parts of Medicare

Each part of Medicare offers different types of coverage, so it’s essential to understand how they work together to provide comprehensive care.

Medicare Part A: Hospital Insurance

Medicare Part A is often referred to as hospital insurance because it helps cover the costs associated with inpatient care. This includes:

- Hospital stays: Part A covers the cost of your room, meals, and nursing care when you’re admitted to the hospital.

- Skilled nursing facility care: If you need ongoing care after a hospital stay, Part A may cover your stay in a skilled nursing facility.

- Hospice care: For those with a terminal illness, Part A helps cover hospice care to provide comfort and support.

- Home health care: Part A may cover the cost of skilled nursing care or therapy services in your home.

Medicare Part B: Medical Insurance

Part B covers the cost of medically necessary services, including:

- Doctor visits: This includes visits to primary care physicians and specialists.

- Outpatient care: Part B covers services you receive without being admitted to the hospital, such as diagnostic tests and surgeries.

- Preventive services: These are services like screenings and vaccinations aimed at preventing illness or detecting conditions early.

Medicare Part C: Medicare Advantage

Medicare Advantage plans, also known as Part C, are offered by private insurance companies and must cover everything included in Parts A and B. Many plans also offer additional benefits, such as:

- Vision and dental coverage: Some plans include routine vision and dental services.

- Prescription drug coverage: Many Medicare Advantage plans include Part D coverage for prescription drugs.

- Wellness programs: Some plans offer memberships to fitness centers or access to health coaching services.

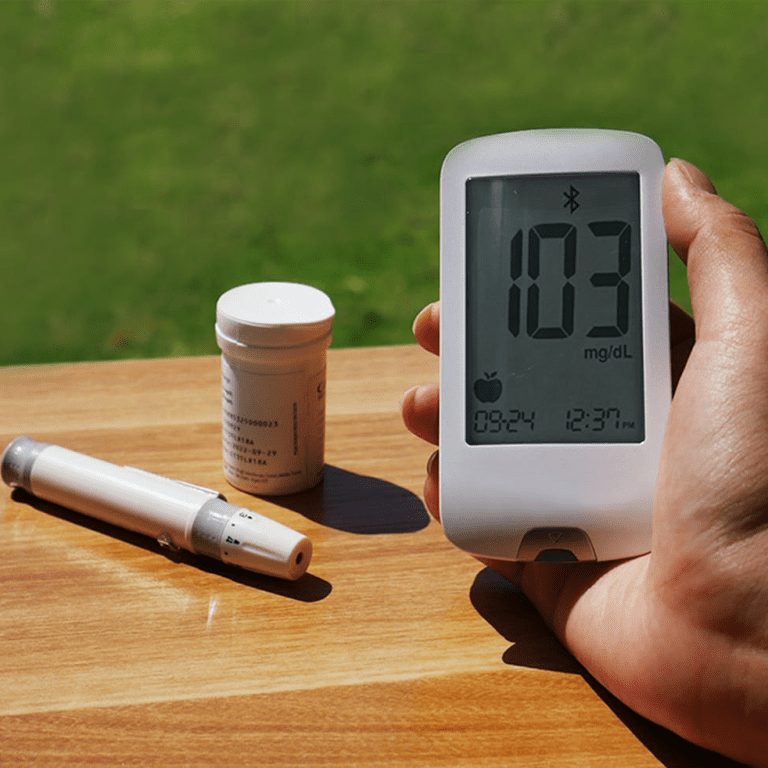

Medicare Part D: Prescription Drug Coverage

Part D helps cover the cost of prescription medications. Each plan has a formulary, which is a list of covered drugs, and your out-of-pocket costs will depend on the specific medications you need. Part D plans vary by provider, so it’s important to choose one that covers your medications at a cost you can manage.

How Do You Enroll in Medicare?

Enrolling in Medicare is a straightforward process, but it’s essential to follow the correct steps to ensure you’re covered.

Automatic Enrollment

If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Part A and Part B when you turn 65. You’ll receive your Medicare card in the mail about three months before your birthday.

Manual Enrollment

If you’re not receiving Social Security benefits, you’ll need to sign up manually. You can enroll online at the Social Security website, by phone, or by visiting your local Social Security office. Be sure to do this during your Initial Enrollment Period to avoid penalties.

Choosing Additional Coverage

Once you’re enrolled in Original Medicare (Parts A and B), you can decide whether you want to add a Medicare Advantage Plan (Part C) or a Medicare Part D plan for prescription drug coverage. Consider your healthcare needs and budget when making these decisions.

What to Expect During the Enrollment Period

The Medicare enrollment period is a critical time to review your options and make decisions about your coverage. Here’s what you can expect:

Research and Compare Plans

Use the Medicare Plan Finder tool to compare the benefits and costs of different Medicare Advantage and Part D plans. Make sure the plan you choose covers your medications and preferred healthcare providers.

Seek Help if Needed

If you’re unsure about which plan to choose, consider talking to a licensed insurance agent who specializes in Medicare. They can help you understand your options and make an informed decision.

Submit Your Application

Once you’ve chosen your coverage, submit your application before the end of your enrollment period. If you’re enrolling in a Medicare Advantage or Part D plan, the insurance company will send you information about your new coverage, including a membership card.

Common Pitfalls to Watch Out For

Medicare enrollment can be tricky, and there are a few common mistakes you’ll want to avoid:

Missing Deadlines

Failing to enroll during your Initial Enrollment Period can result in higher premiums and delayed coverage. Mark your calendar with key dates and set reminders to ensure you don’t miss any deadlines.

Not Understanding Your Coverage

Medicare has different parts that cover various services. Make sure you understand what each part covers and how they work together. This will help you avoid unexpected out-of-pocket costs and ensure you’re getting the coverage you need.

Choosing the Wrong Plan

Selecting a Medicare Advantage or Part D plan that doesn’t meet your needs can leave you with inadequate coverage. Take the time to compare plans and choose one that fits your healthcare needs and budget.

How to Make the Most of Your Medicare Coverage

Once you’re enrolled in Medicare, it’s important to make the most of your coverage. Here are a few tips:

Stay Informed About Your Benefits

Medicare offers a wide range of benefits, from preventive services to chronic care management. Stay informed about what’s covered and take advantage of the services that can help you stay healthy.

Review Your Coverage Annually

Your healthcare needs may change over time, and so may the plans available to you. Each year during the Annual Enrollment Period, review your coverage to make sure it still meets your needs. If necessary, make changes to your plan for the upcoming year.

Keep Track of Your Medical Expenses

Maintain a record of your medical expenses, including doctor visits, prescriptions, and any other services you receive. This can help you stay within your budget and avoid unexpected costs.

Ready to Get Started? Here’s What to Do Next

Now that you have a better understanding of Medicare and the enrollment process, it’s time to take action. Start by marking your calendar with important dates, like your Initial Enrollment Period, and gather the information you need to make informed decisions.

If you’re feeling uncertain, don’t hesitate to reach out for help. Licensed insurance agents, as well as online resources, can provide guidance and answer your questions. The key is to stay informed and proactive so you can choose the coverage that’s right for you.

Taking the Next Step

Enrolling in Medicare is a significant milestone, and it’s one that requires careful consideration and planning. By understanding the different parts of Medicare, knowing when to enroll, and avoiding common pitfalls, you can confidently navigate the enrollment process and secure the coverage you need. Remember, the more informed you are, the better prepared you’ll be to make the best choices for your health and well-being.

Contact Information:

Email: [email protected]

Phone: 2025554567