Key Takeaways

-

Medicare is split into parts that appear straightforward, but the fine print often reveals gaps, extra costs, and coverage limitations that can surprise you.

-

Understanding what each part doesn’t cover in 2025 is as crucial as knowing what it does. Without this, your out-of-pocket costs could grow quickly.

The Basic Structure Looks Simple—But It’s Only the Beginning

At first glance, Medicare seems neatly divided: Part A covers hospital care, Part B handles outpatient services, Part D addresses prescription drugs, and Part C (Medicare Advantage) offers an alternative way to receive these benefits.

But while the structure appears clean, what’s not immediately obvious are the nuances, gaps, and potential financial exposure built into each part. Here’s where it gets more complex—and why just reading a brochure or summary might not prepare you for the full picture.

What Part A Doesn’t Spell Out

Medicare Part A is often referred to as hospital insurance, and for many, it comes premium-free if you’ve worked at least 40 quarters (10 years). It covers:

-

Inpatient hospital stays

-

Skilled nursing facility care (with strict rules)

-

Hospice care

-

Some home health care

What’s not always obvious:

-

You still have a deductible. In 2025, the Part A deductible is $1,676 per benefit period, not per year. If you’re hospitalized again after 60 days, you may face another deductible.

-

Skilled nursing isn’t unlimited. You must be admitted as an inpatient for at least 3 days before a skilled nursing facility stay is covered. And even then, full coverage only lasts 20 days.

-

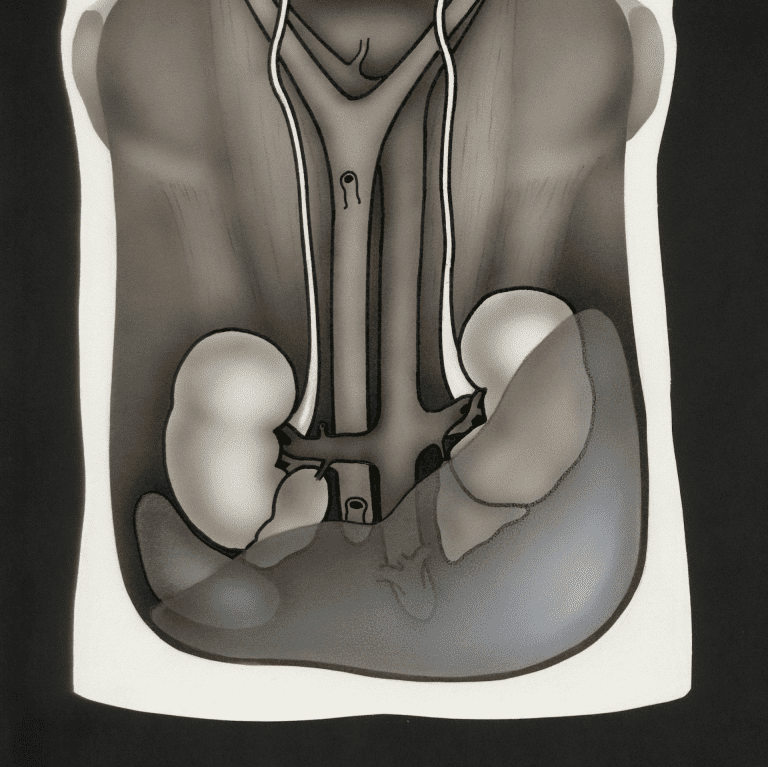

Long-term care isn’t covered. Custodial care, assisted living, or help with daily activities in a nursing home are not paid for by Part A.

Part B Has Costs You May Not Expect

Part B covers things like doctor visits, outpatient procedures, lab work, and preventive services. But while it sounds thorough, it comes with fine print:

-

Monthly premium in 2025: $185 (standard), with higher-income earners paying more based on their tax return from two years prior.

-

Annual deductible: $257 in 2025. After that, you pay 20% of most services (called coinsurance).

-

No out-of-pocket maximum. If you need extensive outpatient care, those 20% coinsurance amounts can really add up.

-

Not all services are covered. Routine vision, hearing, and dental care are not included under Part B.

Part D Coverage Isn’t as Straightforward as It Sounds

Prescription drug coverage under Part D often sounds appealing—until you dig into the structure. While 2025 brings some positive changes, there are still pitfalls:

-

There’s a deductible. In 2025, plans can charge up to $590 before coverage kicks in.

-

Coverage isn’t linear. You pay different amounts depending on what coverage phase you’re in—deductible, initial, and catastrophic.

-

Out-of-pocket cap helps, but still exists. There’s now a $2,000 cap on out-of-pocket costs for prescriptions. Once reached, your plan pays 100%, but getting there can still be costly.

-

Formularies vary. Not all drugs are covered, and tiers affect how much you pay.

Part C (Medicare Advantage) Offers Simplicity—But Adds Complexity

Medicare Advantage (Part C) plans bundle Parts A, B, and usually D into one. The convenience sounds ideal, but it’s important to recognize the tradeoffs:

-

You still pay Part B premiums. These don’t go away just because you enroll in Part C.

-

Networks matter. Most plans have limited provider networks. You might need referrals or face higher costs out-of-network.

-

Plans can change annually. Benefits, copays, and provider networks can shift every year.

-

Extra benefits vary. Many plans advertise extras like vision and hearing, but coverage details differ and may not meet all your needs.

-

Out-of-pocket maximums exist. In 2025, the in-network limit is $9,350. If your plan includes out-of-network coverage, the combined maximum can be as high as $14,000.

What You Pay Can Depend on Timing

When you enroll—and how you manage your coverage after that—can greatly affect your costs and access to care:

-

Missing your Initial Enrollment Period (IEP) could mean late penalties, which are permanent in the case of Part B and D.

-

Annual Enrollment (Oct 15 – Dec 7) lets you switch plans, but outside this window, changes usually require a qualifying event.

-

Special Enrollment Periods (SEPs) are only triggered by life changes, like moving or losing employer coverage.

-

Review your Annual Notice of Change (ANOC). Plan costs and coverage often shift every year, and not reviewing this could mean surprise expenses.

Medicare Doesn’t Cover Everything

There’s a common assumption that Medicare will be a complete safety net. But it doesn’t cover:

-

Routine dental, vision, and hearing services

-

Long-term custodial care (like nursing homes)

-

Foreign travel health emergencies (except in rare cases)

-

Most prescription eyeglasses, hearing aids, or dentures

-

Cosmetic procedures

These costs come out-of-pocket unless you have other coverage—like a Medigap plan or retiree insurance—to fill in the blanks.

Medigap Helps—But Isn’t an Option for Everyone

Medigap (or Medicare Supplement) plans are designed to cover some of the out-of-pocket costs that Parts A and B leave behind. But:

-

You can’t combine Medigap with Part C. If you’re in a Medicare Advantage plan, you’re not eligible for a Medigap policy.

-

Enrollment can be restricted. If you don’t sign up during your Medigap Open Enrollment Period (which starts the month you’re both 65 and enrolled in Part B), insurers in many states can deny you based on health.

-

Premiums vary. Though we won’t get into prices, know that plans are priced differently depending on the insurer, your age, and location.

Annual Changes Mean You Have to Stay Alert

Every year, Medicare costs, benefits, and rules are subject to change. For 2025:

-

Part A deductible increased to $1,676

-

Part B premium rose to $185, with deductible now $257

-

Part D cap on drug costs is now $2,000

-

Medicare Advantage MOOP is now $9,350 (in-network)

These changes make it important to reevaluate your coverage each year. What worked last year might not be ideal now.

What You Can Do Now to Stay Protected

Here are proactive steps to help you avoid costly surprises:

-

Review your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) regularly.

-

Use Medicare’s Plan Finder tool each year before Annual Enrollment.

-

Ask about the total cost of care, not just premiums.

-

Confirm network participation with your doctors annually if you’re in a Part C plan.

-

Talk to a licensed insurance agent listed on this website to ensure you’re not overlooking important coverage gaps.

Understand the Whole Picture Before You Choose

Choosing your Medicare coverage in 2025 means more than just picking a part and hoping for the best. You need to understand how Parts A, B, C, and D interact—and more importantly, what they don’t cover. The consequences of overlooking those details can show up as unexpected bills and limited care options when you need them most.

If you’re unsure which route offers the right balance of costs, coverage, and flexibility, now is the time to explore your options. Speak with a licensed insurance agent listed on this website to ensure your Medicare coverage aligns with your health and financial needs.