Key Takeaways

-

Medicare eligibility is more nuanced than just turning 65—several paths allow you to qualify for coverage.

-

Understanding the criteria ensures you or your loved ones don’t miss out on vital health benefits.

Breaking Down Medicare Eligibility in 2025

Medicare serves as a cornerstone of healthcare coverage in the U.S., but qualifying isn’t as straightforward as you might think. Whether you’re nearing retirement age, living with a disability, or facing certain health conditions, knowing the ins and outs of eligibility helps you plan better. Let’s dive into who actually qualifies for Medicare in 2025 and what it means for you.

Standard Eligibility: Age and Work History

Turning 65: The Gateway to Medicare

Most people qualify for Medicare when they turn 65. But there’s more to it than blowing out birthday candles. To qualify, you need to:

-

Be a U.S. citizen or permanent resident who has lived in the U.S. for at least five continuous years.

-

Have worked (or have a spouse who worked) and paid Medicare taxes for at least 10 years (40 quarters).

This work history is what makes you eligible for premium-free Part A, which covers hospital services. If you don’t meet this requirement, you can still buy into Medicare by paying monthly premiums for Part A.

Timing Matters: Initial Enrollment Period

Once you hit 65, your Initial Enrollment Period (IEP) opens. This seven-month window includes the three months before your 65th birthday, your birthday month, and the three months after. Enrolling during this time ensures you avoid late enrollment penalties. Missing these deadlines can lead to financial consequences that could last for years. Knowing the exact dates and being proactive helps you avoid unnecessary complications.

Early Access: Disability-Based Eligibility

Under 65? Medicare Still Applies

Medicare isn’t reserved for those over 65. If you’re under 65 and have a qualifying disability, you can receive Medicare benefits after a waiting period. Specifically, you’re eligible if:

-

You’ve received Social Security Disability Insurance (SSDI) for 24 months.

Once this waiting period ends, Medicare automatically kicks in. This coverage can be a lifeline, especially if your condition limits your ability to work or access private insurance. It’s a safety net that many don’t realize exists, offering stability during challenging times.

No Waiting Period for Certain Conditions

Some conditions allow you to bypass the 24-month waiting period entirely. For example:

-

End-Stage Renal Disease (ESRD): If you require regular dialysis or a kidney transplant, you qualify for Medicare.

-

Amyotrophic Lateral Sclerosis (ALS): Medicare begins as soon as your SSDI benefits start.

These exceptions ensure immediate access to critical care, reducing delays in treatment and offering peace of mind.

Income-Based Assistance: Medicaid Dual Eligibility

When Medicare Alone Isn’t Enough

If you have limited income and resources, you might qualify for both Medicare and Medicaid, known as dual eligibility. In 2025, dual-eligible individuals can receive additional assistance for premiums, deductibles, and copayments. Programs like the Qualified Medicare Beneficiary (QMB) or Specified Low-Income Medicare Beneficiary (SLMB) can cover costs that Medicare doesn’t. These programs bridge gaps in coverage, making healthcare more accessible and affordable for those who need it most.

Being dual-eligible also means access to coordinated care between Medicare and Medicaid, simplifying processes and reducing administrative burdens. It’s worth exploring if you face financial constraints.

Special Cases: Enrollment Exceptions

Working Beyond 65

What happens if you’re still working when you turn 65? If your employer provides health insurance, you can delay Medicare enrollment without penalty. However, your employer’s plan must meet specific criteria to qualify as creditable coverage. Always verify with your benefits administrator to avoid unexpected costs later. Additionally, knowing how your employer’s coverage integrates with Medicare is crucial to avoid gaps or overlaps.

Foreign Residency

Living abroad doesn’t necessarily exclude you from Medicare, but coverage is limited. You’ll need to return to the U.S. for most Medicare services. Enrolling on time is still critical to avoid penalties when you eventually need coverage stateside. Understanding the nuances of coverage while abroad can save you from surprises during emergencies.

Late Enrollment and Penalties: What You Need to Know

Avoiding the Pitfalls

Missing your enrollment period can lead to penalties that last a lifetime. Here’s how they work:

-

Part A: If you have to buy Part A and don’t enroll when first eligible, your monthly premium increases by 10%. You’ll pay this penalty for twice the number of years you delayed.

-

Part B: For each 12-month period you delay enrollment, your premium increases by 10%. This penalty is permanent.

These penalties emphasize the importance of timely action. Enrolling when first eligible ensures you avoid unnecessary financial burdens that could impact your healthcare access.

Special Enrollment Period (SEP)

Certain situations allow you to sign up late without penalties. For example:

-

Losing employer coverage.

-

Moving out of a plan’s service area.

These scenarios trigger an eight-month SEP, giving you time to enroll in Medicare without penalties. Being aware of SEPs can save you from costly oversights and ensure seamless transitions.

What About Medicare Advantage?

Understanding the Alternatives

While Medicare Advantage (Part C) isn’t a qualification in itself, it’s an option once you’re eligible for Parts A and B. These plans bundle hospital, medical, and often prescription drug coverage. However, availability and coverage vary by location. Understanding your options within Medicare Advantage helps you tailor your healthcare to fit your needs, whether it’s extra benefits or lower out-of-pocket costs.

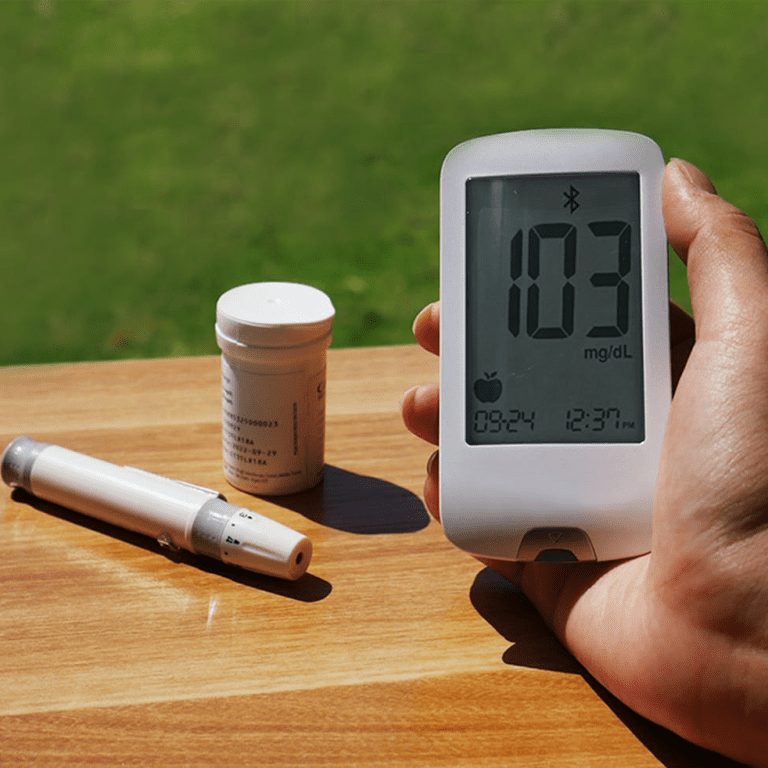

Prescription Drug Coverage: Part D Basics

Everyone Can Benefit

Part D is available to anyone eligible for Medicare. It’s optional but essential if you take prescription medications regularly. Enrolling as soon as you’re eligible helps you avoid penalties, which increase the longer you delay. Even if you don’t take many prescriptions now, having Part D ensures you’re covered for future needs, offering financial protection against high drug costs.

The 2025 $2,000 Cap

In 2025, Medicare introduces a $2,000 out-of-pocket cap on prescription drug costs, making Part D coverage even more beneficial. This cap eliminates financial strain for those with high medication expenses, ensuring essential prescriptions remain accessible without overwhelming costs. It’s a groundbreaking change that redefines affordability in Medicare.

Special Programs and Benefits

Preventive Services

Medicare covers a range of preventive services, including screenings, vaccines, and annual wellness visits. Staying proactive about your health is easier with these benefits. Preventive care not only improves long-term health outcomes but also reduces medical expenses by addressing issues early.

Chronic Care Management

For those managing multiple chronic conditions, Medicare’s chronic care programs provide additional support. This includes care coordination and personalized health plans, ensuring you receive consistent and comprehensive care. These services are invaluable for maintaining quality of life and reducing complications from chronic illnesses.

Your Next Steps

Understanding Medicare’s eligibility rules ensures you make informed decisions about your healthcare. Whether you’re turning 65, managing a disability, or navigating dual eligibility, taking action at the right time is crucial. Keep track of deadlines, review your options, and seek assistance if you’re unsure. Medicare can be complex, but the benefits it provides are well worth the effort. Proactive planning is the key to maximizing your Medicare experience and securing your health future.