Key Takeaways

-

Medicare Part B premiums and deductibles have increased in 2025, but the core benefits and coverage structure remain largely the same.

-

Evaluating whether Medicare Part B is still worth it depends on your healthcare needs, income level, and whether you have access to other forms of coverage.

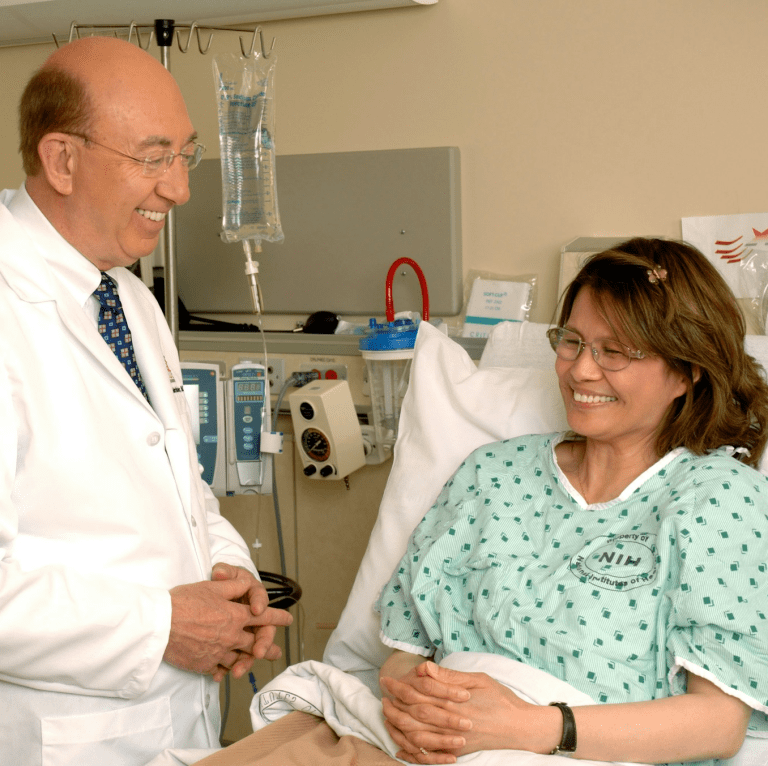

What Medicare Part B Covers in 2025

Medicare Part B continues to offer coverage for a broad range of outpatient medical services in 2025. These include:

-

Doctor visits (including primary care and specialists)

-

Preventive services like screenings and vaccines

-

Outpatient care at hospitals and clinics

-

Durable medical equipment (DME)

-

Laboratory services and diagnostic tests

-

Mental health services (both outpatient and partial hospitalization)

This range of services ensures that you’re covered for day-to-day healthcare needs and essential preventive care, helping you manage chronic conditions and detect issues early.

Understanding the 2025 Cost Increases

In 2025, the standard monthly premium for Medicare Part B has risen to $185. That’s an increase from $174.70 in 2024. The annual deductible has also increased to $257, up from $240 the previous year.

These cost increases reflect rising healthcare expenditures and inflation adjustments. While they’re not unexpected, they do impact your monthly budget and may influence how you value the benefits of remaining enrolled in Part B.

Additional Cost Factors

-

Income-Related Monthly Adjustment Amount (IRMAA): If your modified adjusted gross income exceeds certain thresholds, you pay higher premiums.

-

Coinsurance and Copayments: After meeting the deductible, you generally pay 20% of the Medicare-approved amount for most Part B services.

Who Must Enroll in Medicare Part B?

Medicare Part B is optional, but for many people, it is essential. You’re typically first eligible to enroll during your Initial Enrollment Period, which begins three months before your 65th birthday, includes your birth month, and ends three months after.

If you delay enrollment without having other creditable coverage, you could face a permanent late enrollment penalty. This penalty grows the longer you wait and applies to your premiums for as long as you have Part B.

When Medicare Part B Might Not Be Necessary

There are a few situations where it may make sense to delay or drop Part B:

-

You’re still working and have creditable employer coverage.

-

You’re covered under a spouse’s current employer plan.

-

You’re enrolled in certain Veterans Affairs (VA) or military programs.

In these cases, you can delay Part B without penalty, but you must be careful to enroll during a Special Enrollment Period once that coverage ends.

What You Get for the Premium in 2025

Despite the higher cost in 2025, Medicare Part B still provides value for many. Here’s why:

-

Reliable Coverage: Part B pays for 80% of covered services after you meet your deductible.

-

Predictability: Costs are generally more predictable than relying solely on private plans or going without insurance.

-

Access to Providers: You can see any provider who accepts Medicare, which includes the majority of healthcare professionals in the U.S.

-

Preventive Care: Many screenings and services are covered with no cost-sharing, supporting early detection and disease prevention.

How Part B Works with Other Coverage

If you have additional coverage, such as a Medigap plan, Medicaid, or retiree health benefits, Medicare Part B usually acts as the primary payer. This means Part B pays first, and your other coverage picks up remaining costs.

This layered approach can help reduce out-of-pocket expenses significantly. However, coordination depends on the type of secondary coverage you have, and you’ll need to understand how each interacts with Medicare.

Should You Drop Part B in 2025?

Some people consider dropping Part B due to the rising cost, especially if they’re on a tight income. But doing so can be risky. Without Part B:

-

You lose access to outpatient services under Medicare.

-

You’ll face a late enrollment penalty if you decide to rejoin later.

-

You may not be eligible for supplemental coverage that requires active Part B enrollment.

Carefully evaluate your healthcare needs. If you frequently visit specialists, need lab tests, or require preventive services, the monthly premium may be well worth it.

How Income Affects Your Part B Premium in 2025

The standard monthly premium of $185 applies to most people, but if your income in 2023 (as reported on your tax return) exceeds certain thresholds, you pay more.

For 2025, IRMAA brackets begin for individuals with incomes above $106,000 and for married couples filing jointly above $212,000. These higher premiums can range significantly, so it’s important to verify your status each year.

If your income has gone down due to life events like retirement, divorce, or the death of a spouse, you can appeal to Social Security to reduce your IRMAA amount.

Special Circumstances in 2025: Medicare Part B and the PSHB Program

For postal retirees and annuitants under the new Postal Service Health Benefits (PSHB) Program starting January 1, 2025, Medicare Part B enrollment is mandatory for continued drug and health coverage—unless you fall under a specific exemption.

If you’re a postal retiree or dependent affected by this rule, skipping Part B could result in the loss of your drug coverage under the integrated Part D Employer Group Waiver Plan (EGWP). It also limits your re-enrollment options.

In these cases, the Part B premium becomes more than just a monthly bill—it’s a requirement to maintain access to broader healthcare and pharmacy benefits.

Why Preventive Services Still Make Part B Valuable

Preventive care remains a cornerstone of Medicare Part B. Covered services in 2025 include:

-

Cancer screenings (like mammograms and colonoscopies)

-

Diabetes screenings

-

Cardiovascular disease screenings

-

Flu, pneumonia, and COVID-19 vaccines

These services are fully covered if your provider accepts Medicare assignment. They play a vital role in keeping you healthy and potentially avoiding more expensive treatments later.

The Risk of Going Without Part B Coverage

If you go without Medicare Part B in 2025, you may save money in the short term but face higher long-term costs:

-

Paying full price for outpatient services

-

Losing eligibility for Medigap or other supplemental options

-

Facing penalties for late enrollment

Additionally, it’s hard to predict future health issues. While you may be healthy now, Part B provides peace of mind and access to care if things change.

Comparing the Value to the Cost

Whether Medicare Part B is worth keeping in 2025 comes down to personal circumstances. Consider the following questions:

-

Do you regularly visit doctors or specialists?

-

Do you need frequent lab work or diagnostic testing?

-

Are you on a limited income where every dollar counts?

-

Are you eligible for other forms of coverage?

If the answer to the first two questions is yes, Part B is likely a valuable investment, even with its higher cost this year. If you’re mostly healthy and have strong alternative coverage, it might be worth exploring your options—but with caution.

Weighing Medicare Part B Carefully in 2025

The increase in Medicare Part B premiums and deductibles in 2025 is noticeable, but not surprising. The core benefits remain steady: access to outpatient care, preventive services, and reliable cost-sharing.

Ultimately, whether it’s worth sticking with depends on your personal health needs, income, and the availability of other coverage. If you’re unsure, it’s wise to speak with a licensed agent listed on this website to make the best decision for your situation.