Key Takeaways

-

Medicare fraud scams are on the rise in 2025, with scammers targeting seniors through various deceptive tactics. Knowing the warning signs can help you avoid becoming a victim.

-

Protecting yourself involves being cautious with your Medicare number, verifying information with official sources, and staying informed about common scam tactics.

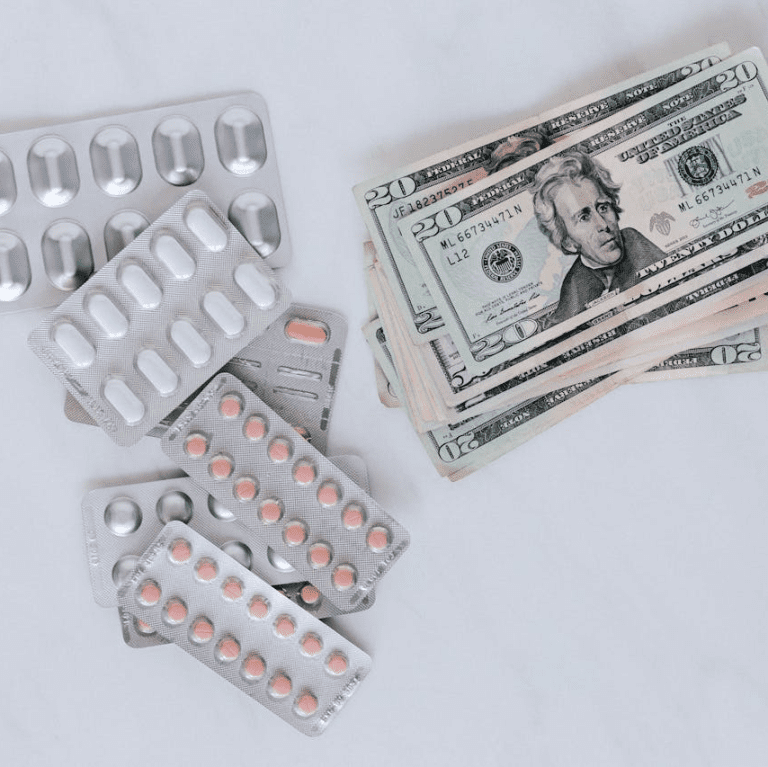

Understanding Medicare Fraud Scams and Their Growing Impact

Medicare fraud is a billion-dollar industry for scammers, and seniors are often the primary targets. In 2025, fraudsters are using increasingly sophisticated methods to trick beneficiaries into revealing sensitive information, signing up for unnecessary services, or paying for non-existent benefits. Being aware of these scams is the first step in keeping yourself protected.

1. Fake Medicare Representatives Asking for Personal Information

One of the most common scams involves fraudsters pretending to be Medicare representatives. They might call you, send letters, or even show up at your doorstep claiming to need your Medicare number to issue a new card, provide additional benefits, or verify your coverage.

How This Scam Works

-

Scammers contact you, claiming to be from Medicare or a government agency.

-

They insist that you need to provide personal information such as your Medicare number, Social Security number, or bank details.

-

If you comply, they use your information to commit identity theft, file false claims, or charge you for services you never received.

How to Protect Yourself

-

Medicare will never call or visit you to ask for your Medicare number or other personal details.

-

If you receive a suspicious call, hang up and call Medicare directly at 1-800-MEDICARE to verify the claim.

-

Never share your Medicare number with anyone who contacts you unexpectedly.

2. Billing for Services That Were Never Provided

Scammers sometimes bill Medicare for services, tests, or medical equipment that were never provided to you. You may not even realize you’re being scammed until you check your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB).

How This Scam Works

-

A fraudulent provider submits a claim for a service you never received.

-

The scammer may even use stolen Medicare numbers to bill multiple beneficiaries for expensive treatments or equipment.

-

These fraudulent claims can go unnoticed for months if you don’t regularly review your Medicare statements.

How to Protect Yourself

-

Check your Medicare Summary Notice (MSN) and Explanation of Benefits (EOB) regularly.

-

If you see unfamiliar charges, report them to Medicare at 1-800-MEDICARE.

-

Keep a personal record of your doctor visits and treatments to compare against your Medicare statements.

3. Bogus Free Health Screenings Leading to Identity Theft

Scammers often set up fake health screening events at community centers, senior homes, or even through online advertisements, promising free tests in exchange for your Medicare details.

How This Scam Works

-

Fraudsters set up a fake health screening event and ask attendees for their Medicare number.

-

They claim that Medicare fully covers the cost, so there’s no charge.

-

After obtaining your information, they submit fraudulent claims or use your details for identity theft.

How to Protect Yourself

-

Only participate in health screenings conducted by trusted medical providers.

-

Never share your Medicare number unless you’ve verified the legitimacy of the provider.

-

If you are unsure, call Medicare to confirm whether the screening is officially covered.

4. Durable Medical Equipment (DME) Scams

Some scammers target seniors by offering free or low-cost medical equipment such as braces, wheelchairs, or walkers. They bill Medicare for high-cost equipment that was never provided or unnecessary.

How This Scam Works

-

You receive a call, email, or advertisement promising free or low-cost medical equipment.

-

The scammer pressures you into providing your Medicare number.

-

They bill Medicare for expensive equipment, even if you never receive it or don’t need it.

How to Protect Yourself

-

Be skeptical of unsolicited offers for medical equipment.

-

Only obtain durable medical equipment from a Medicare-approved provider.

-

If you receive equipment you didn’t order, report it immediately.

5. Fake Medicare Drug Plan Enrollments

During Medicare Open Enrollment or other special periods, scammers may try to trick you into signing up for a fake prescription drug plan, claiming it offers better coverage or lower costs.

How This Scam Works

-

A scammer contacts you by phone or online, offering a better Medicare drug plan.

-

They pressure you into providing personal and financial details.

-

Once they have your information, they steal your identity or enroll you in an unauthorized plan.

How to Protect Yourself

-

Medicare and official health plan representatives will never pressure you to enroll over the phone or through unsolicited emails.

-

Always verify plan details through the official Medicare website (Medicare.gov) or by calling 1-800-MEDICARE.

-

Be wary of high-pressure tactics or requests for personal details.

How to Report Medicare Fraud

If you suspect Medicare fraud, take immediate action:

-

Call Medicare at 1-800-MEDICARE (1-800-633-4227).

-

Contact the Senior Medicare Patrol (SMP) in your state for fraud prevention assistance.

-

Report identity theft to the Federal Trade Commission (FTC) at IdentityTheft.gov.

Staying Informed Is Your Best Defense

Medicare scams are constantly evolving, and fraudsters are finding new ways to deceive seniors. Staying updated on the latest scam tactics is crucial to protecting yourself and your benefits.

-

Sign up for Medicare fraud alerts on Medicare.gov.

-

Educate yourself about your Medicare rights and protections.

-

Talk to a trusted family member or caregiver if you receive suspicious calls or messages.

Secure Your Medicare Benefits with the Right Guidance

Navigating Medicare fraud risks can be overwhelming, but you don’t have to do it alone. Speaking with a licensed agent listed on this website can help ensure that you make informed choices and avoid scams. If you have concerns about your Medicare plan or suspect fraudulent activity, reach out to a licensed agent today.